Highlights

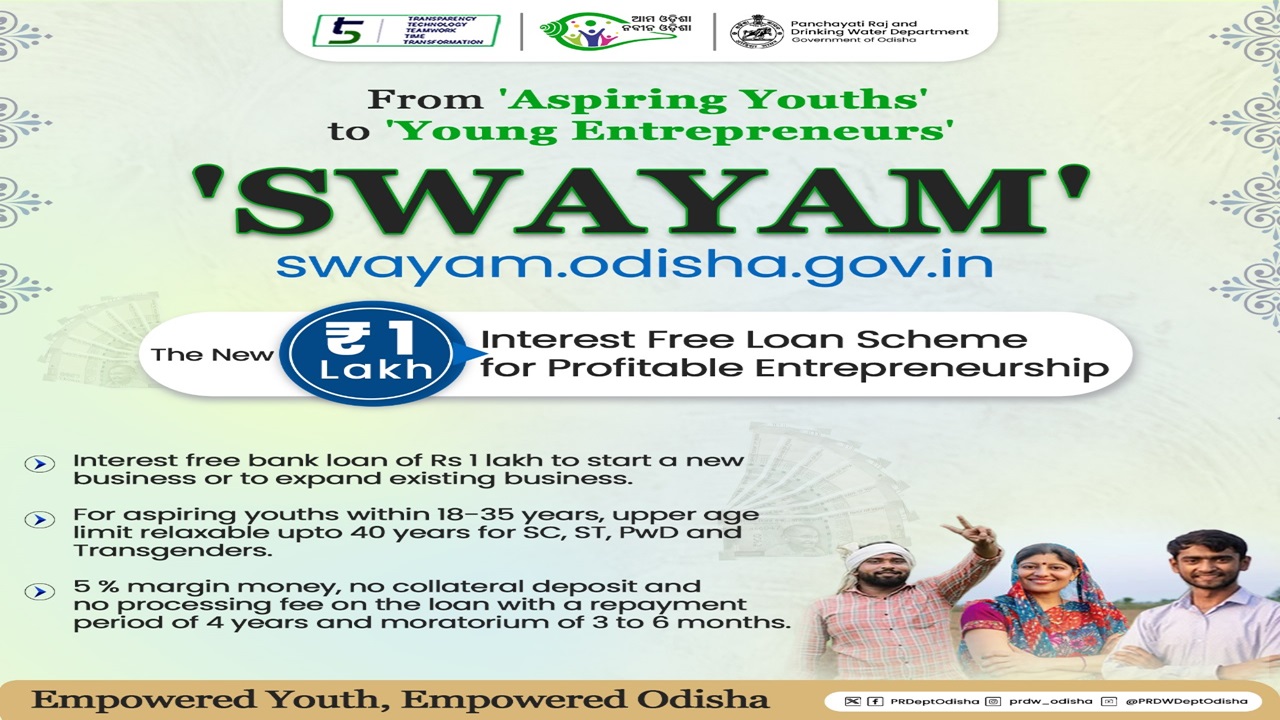

- Odisha Swayam (Swatantra Yuva Udyami) Scheme offers : -

- Interest Free Loan for project up to Rs 1 Lakh.

- Loan can be used to set up new enterprise or expansion of existing unit.

- Loan provided is collateral free.

- Zero Processing Fee.

Website

Customer Care

- For any queries beneficiaries can visit the nodal department office of the scheme.

Information Brochure

| |

|

|---|---|

| Name of Scheme | Odisha Swayam Scheme |

| Launch Year | 2024 |

| Benefits | Interest Free Loan up to Rs 1 Lakh |

| Beneficiary | Unemployed or underemployed youth of the state. |

| Nodal Department | |

| Subscription | Subscribe Here to Get Update Regarding Scheme. |

| Mode of Apply |

|

Scheme Introduction: A Brief Overview

- There are a number of skilled youth in Odisha who wish to set up their own micro-enterprises.

- However, they often face various challenges due to lack of credit and cumbersome, lengthy loan procedures.

- To address this issue, the state government has announced a new scheme called 'Odisha SWAYAM Scheme' (Swatantra Yuva Udyami).

- With this initiative, the government will provide financial assistance to youth who want to start their entrepreneurial journey.

- It is an Interest free credit guarantee self employment scheme for the youth of the state who are basically unemployed or underemployed.

- The announced scheme is also known by other names; such as, 'Odisha Swayam Yojana' or 'Swayam Odisha Jojana' or 'Swatantra Yuva Udyami Odisha'.

- Through the Swayam Scheme Odisha, youth in the age group of 18 to 35 years from both rural and urban areas can avail an interest free bank loan up to Rs 1 lakh.

- The scheme offers a collateral free loan with zero processing fee benefits.

- However, applicants have to pay 5% of margin money, which means the interest free amount provided to the beneficiary will be Rs 95,000/-

- The loan under the scheme will be disbursed to the beneficiaries account in two instalments.

- The interest applicable on the loan will be borne by the state government.

- Beneficiaries can repay this loan in a period of 4 years, which includes 3 to 6 months of moratorium period.

- Loans also cover the insurance coverage of the stocks whose charges are to be borne by the borrower.

- However, if anyone is looking for a loan up to Rs 10 lakh can seek the benefits of Udyam Kranti Yojana.

- Additionally, if you are an unorganised sector worker, you can apply for a loan under Odisha Shram Kalyan Yojana.

- Housing and Urban Development department of Odisha is the nodal authority of the schemes for urban areas and Panchayati Raj and Drinking water department for Rural areas.

- Odisha Swayam scheme aims to cover around 50,000 youths from the entire state.

- Applicants in the age group of 18-35 years (18-40 for special categories) and families covered under the BSKY and KALIA schemee are eligible for the scheme.

- The annual income of the family should not exceed Rs 3 lakh, and applicants must be UDYAM Registered.

- Meanwhile, applicants declared defaulter by any bank or financial institutions or any of its family members who are already taking benefits of this scheme, are not eligible.

- Odisha Swayam scheme will remain in operation for next 5 years from the date of notification, and is likely to be extended by the government further.

- Those looking to set up an enterprise unit or want to expand their existing units can apply for Odisha Swayam Scheme.

- Applicants interested in Odisha Swayam scheme can apply for it online or from Mo Seva Kendra.

- Online application forms for the Swayam Schemee are available at its official website.

- Banks will credit the loan amount once they receive the margin money from the borrower.

Scheme Benefits

- Under the Odisha Swayam Scheme, eligible applicants will receive following benefits : -

- Interest Free Loan for project up to Rs 1 Lakh.

- Loan can be used to set up new enterprise or expansion of existing unit.

- Loan provided is collateral free.

- Zero Processing Fee.

Eligibility Requirements

- Applicants who meet the following guidelines are eligible to avail benefits of Odisha SWAYAM Scheme : -

Urban ApplicantsRural Applicants

- Should be a permanent resident of Odisha.

- Should be in the age group of 18 to 35 years.

- SC/ST/PWD applicants maximum age limit is 40 years.

- Applicants' families are covered under Biju Swasthya Kalyan Yojana or have an annual income less than Rs 3 lakh.

- UDYAM registration or UDYAM assisted registration number is a must for all.

- Should be a permanent resident of Odisha.

- Should be in the age group of 18 to 35 years.

- SC/ST/PWD applicants maximum age limit is 40 years.

- Applicants' families are covered under Biju Swasthya Kalyan Yojana or KALIA or have an annual income less than Rs 2 lakh.

- Must have registered for UDYAM or obtained UDYAM assisted registration number.

Ineligibility Criteria of the Scheme

- Applicants who fulfil the above criteria but also covered in any of the below given parameters are not eligible for Swayam Scheme : -

- Central or State government employee.

- Applicants declared defaulter by bank or any financial institution.

- One of the family members is already taking scheme benefits.

Required Documents

- To submit applications for Odisha SWAYAM Scheme, applicants are required to provide details or attach the copies of following items : -

- Age proof.

- Aadhaar Card

- Voter ID

- PAN card

- 10th Certificate

- Residence Proof.

- Aadhaar Card

- Proof issued by tahsildar

- Voter ID

- Driving license

- Electricity bill

- Ration Card

- Passport Size photographs.

- Self Declaration by transgender applicants of urban areas.

- Udyam registration copy or number.

- Caste Certificate (if any)

- Disabled Certificate (if any)

- Income Certificate/Biju Health Card /KALIA Yojana Card.

- Age proof.

Steps to Apply

- Applicants can apply for the Odisha Swayam scheme through

- Online application form.

- Offline application form.

Online Application

- Eligible applicants can apply for the Odisha Swayam Scheme online.

- Its online application and registration link are available at Swayam Scheme Odisha Portal.

- Select the 'Registration' tab from the home page and choose 'Rural' or 'Urban'.

- Next, applicants need to fill out the registration details and submit it.

- After registration, applicants need to login using their mobile or Aadhaar number.

- Post login, fill out the scheme application form, upload the required documents.

- Submit this duly filled in application form and wait to complete the process.

- Concerned authority will verify your details and documents.

- Successful applicants will be notified through SMS./Email.

Offline Application

- Applicants can also submit their Odisha Swayam Scheme applications offline.

- To do this, they need to visit the nearest Mo Seva Kendra.

- However, applicants of urban areas may also visit NAC/Municipality/Municipal Corporation office.

- Obtain the scheme application form and fill it out with the relevant details.

- Provide the necessary documents and submit them.

- Submitted application will go through the verification stage.

- Applicants shortlisted will receive an intimation via SMS or email.

- Post submitting the margin money i.e. Rs 5,000/-, the loan amount will be credited to the beneficiary account in maximum two installments.

Relevant Links

- Odisha SWAYAM (Swatantra Yuva Udyami) Scheme Registration for Rural.

- Odisha SWAYAM- Swatantra Yuva Udyami Scheme Registration for Urban.

- Odisha SWAYAM Scheme Applicants Login.

- SWAYAM Odisha Scheme Guidelines for Urban.

- SWAYAM Odisha Scheme Guidelines for Rural.

Contact Information

- For any queries beneficiaries can visit the nodal department office of the scheme.

- Housing and Urban Development Department,

Govt of Odisha 3rd Floor,

Kharvel Bhavan, West Wing,

Room No.- 302, Bhubaneswar - 751001 - Panchayati Raj and Drinking Water Department,

Odisha Govt. ,Secretariat Building,Bhubaneswar

Pin- 751001, Odisha, India

Do you have any question regarding schemes, submit it in scheme forum and get answers:

Feel free to click on the link and join the discussion!

This forum is a great place to:

- Ask questions: If you have any questions or need clarification on any aspect of the topic.

- Share your insights: Contribute your own knowledge and experiences.

- Connect with others: Engage with the community and learn from others.

I encourage you to actively participate in the forum and make the most of this valuable resource.

Stay Updated

×

Comments

Rajesh Paik

Rajesh Paik Antaraba via chandragiri block mohana districts gaja pati

Add new comment