Youtube Video

Highlights

- Farmers can avail Short Term Loan at Lower Interest rate of 7% from Banks.

- Farmers can avail Short Term Loan up to Rs. 5 Lakh for Agriculture Requirements.

- Subsidy of 3% per Year to farmer in case of prompt repayment as Prompt Repayment Incentive (PRI).

- Farmers repaying loan on time will get short term loan @ 4% per annum.

- Farmers can take term loan for other Agriculture needs.

Website

Customer Care

- Common Service Centre (CSC) Toll Free Number :- 18001213468

- NABARD Helpline Numbers : -

- 022-26539895.

- 022-26539896.

- 022-26539899.

- Kisan Call Center Helpline Number :- 18001801551

- Department of Animal Husbandry and Dairying Helpline Number : - : 011-23388534

- Common Service Centre (CSC) Helpline Email Id : - helpdesk@csc.gov.in

- NABARD Helpdesk Email id: -helpdesknabskill@nabard.org.

Summary of the Scheme | |

|---|---|

| Name of Scheme | Kisan Credit Card Scheme. |

| Launch Year | August 1998. |

| Benefits | Loan up to Rs 5 lakh to at lower interest rate. |

| Beneficiary | All Farmers. |

| Website | KCC Portal. |

| Nodal Agency | Ministry of Agriculture and Farmers Welfare, Government of India. |

| Implementing Agency | NABARD (National Bank for Agriculture and Rural Development) |

| Subscription | Subscribe here to get Update Regarding Scheme |

| Mode of Application | Through Offline Application. |

Scheme Introduction: A Brief Overview

- Kisan Credit Card Scheme was launched in August 1998 for farmers, providing an easy credit facility from banks at low interest.

- NABARD (National Bank for Agriculture and Rural Development) seeks the implementation of the Kisan Credit Card Scheme as directed by the Department of Financial Services, issued guidelines.

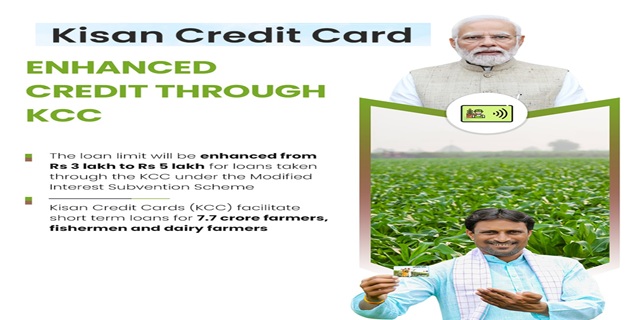

- Kisan Credit Card Scheme from its inception, has covered over 7.34 crore farmers till date across the country, with the largest active cardholder in Uttar Pradesh with 1.1 crore KCC Card.

- Kisan Credit Card Scheme is to be implemented by Public sector Banks, Private Sector Banks, Small Finance Banks, Regional Rural Banks and State Cooperative banks.

- The scheme is formulated to provide monetary help to farmers for farm-related needs.

- The farmer can avail money easily and timely through the Kisan Credit Card from the banks.

- Scheme helps by providing Short-term loan, Term loan and, Small term loan to farmers for the following purpose : -

- For the Cultivation of crop/ Dairy Farming/ (Inland and Marine) Fisheries and Animal Husbandry.

- For post-harvest expenses.

- For Produce Marketing.

- For the Consumption requirements of farmers.

- For working capital for the maintenance of farm assets.

- For investment credit requirements for agriculture and allied farm activities.

- Crop farmers need support in various stages of farming, the scheme will help them to purchase agricultural inputs which will aid their production needs.

- Animal husbandry, Dairying and Fisheries activities play a significant role in generating farm income and it is essential to support farmers engaged in these activities.

- KCC (Kisan Credit Card) facility will meet the short-term requirements of farmers earning their livelihood from crop farming, dairy, fisheries and animal husbandry.

- Separate KCC (Kisan Credit Card) for Animal husbandry, Dairy and Fisheries will be issued by banks. Composite KCC for Agriculture and allied activities will be issued or updated (if the Kisan Credit Card was already issued earlier).

- Eligible farmers engaged in cultivation, dairy, poultry and fisheries will be issued KCC (Kisan Credit Card) within a maximum period of 2 weeks after due verification as per guidelines.

- Interest subvention/Subsidy of 1.5% per annum is provided on short-term agriculture loans to all financial institutions bythe Government of India.

- Bank will provide a short-term loan to farmers at 7% interest.

- The government shall provide 3% per annum subsidy to farmers who will pay their short-term loans timely as Prompt Repayment Incentive (PRI).

- This shall reduce the interest rate to 4% per annum for early loan paying farmers and will encourage them to avail the benefits of the short-term loan under the scheme.

- Any number of transactions can be done i.e. withdrawal and repayment.

- No collateral security is required for loan limit up to Rs. 1.60 lakh. In tie-ups up to Rs. 3 lakh, no security is required.

- Collateral security is required for loans above Rs. 1.60 lakh and up to Rs. 5 lakh.

- Earlier, the scheme offered loans up to Rs 3 lakh, but in the 2025-26 budget, the Indian government has increased the loan amount to Rs 5 lakh.

- Term loan is available at different rates and collateral security is required in the form of land/ assets.

- Maximum permissible loan limit: Short-term loan limit + estimated long-term loan requirement.

- The beneficiary can apply for the Kisan Credit Card Scheme online and offline.

- For further query beneficiary can also contact the helpline number or visitors can also visit the Official Website of Kisan Credit Card Yojana.

Scheme Benefits

- With the Kisan Credit Card Scheme, eligible farmers are entitled to receive following benefits : -

- Loan benefits of up to Rs 5 lakh.

- Interest subvention benefits from 1.5% to 3%.

Benefits to All farmers other than Marginal Crop Farmers

- Farmers can take a short-term Loan up to Rs. 5 Lakh.

- Interest Rate on the Loan will be 7%.

- The Repayment Period of the Loan will be 1 Year.

- A farmer availing a Term loan can be repaid within 5 years.

- RuPay Kisan Credit Cards/ Debit Cards will be provided to Farmers for Easy Withdrawal from ATMs.

- Helpful for farmers living in areas affected by natural calamities.

Benefits to Marginal Crop Farmers

- Marginal farmers can avail loan (as Flexi KCC) between the range of Rs.10,000/- to Rs.50,000/- based on land holding and small-term loan without relating it to the value of land.

- Essential documents needed to obtain loan on Kisan Credit Card are :-

- Application Form duly filled and signed.

- Identity Proof (Aadhaar Card/Pan Card/ Voter ID/ Driving Licence).

- Address Proof.

- Land Record Papers.

- Passport-size photo (2).

- Security documents.

Eligibility Requirements

- All Farmers, Individuals / Joint borrowers who are Owner Cultivators.

- Fisheries and Animal Husbandry Farmers Individuals and Groups.

- Dairy Farmer:s Individuals or Joint Borrower.

- Tenant Farmers, Oral Lessees and Share Croppers.

- Self Help Groups or Joint Liability Groups of Farmers including Tenant farmers, Share Croppers etc.

Required Documents

- Beneficiary must keep the following with them when applying for the Kisan Credit Card Scheme (KCC) : -

- Application Form.

- Two latest passport Size Photographs.

- Identity Proof (Aadhaar Card, Voter ID, Passport etc)

- Land holding documents certified by the Revenue Officer /Online Land Records.

Steps to Apply

- A single one page Application Form of Kisan Credit Card can be obtained from any commercial bank.

- Fill the form carefully, providing all details correctly.

- Attach a copy of the land record along with details of crop sown. Submit it at the concerned bank.

- The form can also be downloaded from website of Commercial Banks or website of Department of agriculture, cooperation and Farmers Welfare, Government of India (agriwelfare.gov.in) or the PM-KISAN Portal (www.pmkisan.gov.in)

- Farmers can also approach Common Service Centres.

- Common Service Centres are authorised to fill the form and transmit the same to the concerned bank branch.

- The corresponding bank will issue a Kisan Credit Card within 15 days after verifying farmer's credentials or shall show the reason for rejection.

Repayment of loan

- Short term loan Kisan Credit Card provided as revolving cash credit limit shall be repayable within one year.

- Term loan component will be repayable within 5 years, depending upon type of investment.

Key Features of the Scheme

- It helps by providing credit support to farmers from banks through the Kisan Credit Card.

- Farmers can avail a short-term loan and Term loan for their agricultural needs.

- The loan amount under the scheme is raised from Rs 3 lakh to Rs 5 Lakh.

- Farmers can easily apply and can avail credit from ATMs through RuPay kisan cards/debit cards.

- Kisan Credit Card issued under the scheme will remain valid for 5 years subject to an annual review.

- The annual review may result in the Continuation/Enhancement/Cancellation of limit of KCC (Kisan Credit Card).

- Besides mandatory crop insurance, farmers can opt for various insurance like health insurance, asset insurance and personal accident insurance which can be paid through KCC (Kisan Credit Card) account.

- No other charges will be charged by bank on farmers for the availability of the Kisan Credit Card like processing fee, documentation, inspection etc. for loan up to Rs. 5 lakh.

- One page form and one time documentation at the time of registration and a simple declaration from the second year onwards is provided to make the process hassle-free.

- Bank will issue Kisan Credit Card within 15 days after verifying farmer credentials or shall show the reason for rejection.

Relevant Links

- Kisan Credit Card Scheme Official Website.

- NABARD (National Bank for Agriculture and Rural Development) Website.

- Reserve Bank of India Website.

- Department of Animal Husbandry and Dairying Website

- KCC Guideline for Animal Husbandry and Dairying.

- Kisan Credit Card (KCC) Application Form.

- Common Service Centre Website.

- KCC PIB Notification.

Contact Information

- Common Service Centre (CSC) Toll Free Number :- 18001213468

- NABARD Helpline Numbers : -

- 022-26539895.

- 022-26539896.

- 022-26539899.

- Kisan Call Center Helpline Number :- 18001801551

- Department of Animal Husbandry and Dairying Helpline Number : - : 011 23388534

- Common Service Centre (CSC) Helpline Email Id : - helpdesk@csc.gov.in

- NABARD Helpdesk Email id: -helpdesknabskill@nabard.org.

- NABARD (National Bank for Agriculture and Rural Development),

Plot C-24, G Block, Bandra Kurla Complex,

BKC Road Bandra East,

Mumbai, Maharashtra 400051. - Department of Agriculture & Cooperation,

Ministry of Agriculture and Farmers Welfare,

Krishi Bhawan Rajendra Prasad Road,

New Delhi-110001.

Also see

Do you have any question regarding schemes, submit it in scheme forum and get answers:

Feel free to click on the link and join the discussion!

This forum is a great place to:

- Ask questions: If you have any questions or need clarification on any aspect of the topic.

- Share your insights: Contribute your own knowledge and experiences.

- Connect with others: Engage with the community and learn from others.

I encourage you to actively participate in the forum and make the most of this valuable resource.

| Person Type | Scheme Type | Govt |

|---|---|---|

Stay Updated

×

Comments

koi to bta rha tha ki kisan…

maximum time period kya hoga…

collateral me jameen girvi…

ਕਿੰਨਾ ਕਰਜ਼ਾ ਲਿਆ ਜਾ ਸਕਦਾ ਹੈ?…

kisan credit card kho gya…

Hi govtschemes.in admin,…

Kisan credit card scheme…

Kisan credit card scheme eligibility

kisan credit card ki limit…

kisan credit card ki limit kese check kare

अ

किसान क्रेडिट कार्ड योजना

Add new comment