Highlights

- Loans up to Rs 50,000 will be provided to start their business.

- The loan is collateral-free.

- Loan also offers a 7% interest grant.

- The loan will be offered for a maximum period of 36 months.

Customer Care

- Rajasthan Local Self Govt Department Phone Number: 0141-2226722

- Email Helpdesk: dlb.lsg@rajasthan.gov.in

Information Brochure

Summary of the Scheme | |

|---|---|

| Name of the Scheme | Rajasthan Mukhyamantri Svanidhi Yojana |

| Launch Year | 2024 |

| Benefits |

|

| Beneficiary | Rajasthan Unorganised Sector Workers |

| Nodal Department | Local Self Government Department. |

| Subscription | Subscribe here to get Update Regarding Scheme |

| Mode of Apply | Online through Rajasthan SSO Portal. |

Scheme Introduction: A Brief Overview

- The Rajasthan Government is continuously making efforts to provide necessary support to the vulnerable families.

- For this, they have started several initiatives to offer economic support.

- Recently, the government has started a new scheme called "Mukhyamantri Svanidhi Scheme".

- This scheme is different to the central government "PM Svanidhi Scheme", which provides financial support to unorganised street vendors.

- However, the PM Svanidhi Yojana doesn't provide support to various unorganised sector workers as they were not eligible.

- In order to fill this gap, the state government launched the Mukhyamantri Svanidhi Scheme.

- Under this scheme, the state government is distributing loans through Nationalised Commercial Banks, Gramin Banks, Private Sector Banks, and Scheduled Small Banks.

- The primary objective of the scheme is: -

- To provide easy loan facilities to needy and vulnerable urban families.

- To increase the capital flow in small businesses and enterprises.

- To encourage self-reliance among the underprivileged.

- The Rajasthan Chief Minister Svanidhi Yojana offers collateral-free, subsidised loans in three phases: -

- In Phase 1, the beneficiary will be granted a loan of Rs 10,000/- for 12 months.

- In Phase 2, the beneficiary will get a Rs 20000 loan for a period of 18 months.

- In Phase 3, beneficiaries will get Rs 50,000 for 36 months.

- The state government will provide a 7% percent interest subsidy on these loans.

- However, the interest subsidy will only be provided if the applicant repays the loan amount within the given schedule.

- The benefit of the scheme will be provided to needy and vulnerable families of the unorganised service sector, including: -

- Gig Workers.

- Transport Worker.

- Domestic Worker.

- Construction Worker.

- Hawkers.

- Waster Workers.

- Rag pickers.

- Artisans.

- To avail of the scheme benefits, the beneficiaries must meet its eligibility criteria (discussed in a later section).

- The loan provided under the scheme is collateral-free, which means beneficiaries are not required to submit any security.

- Application of Mukhyamantri Svanidhi Yojana can be submitted online through the SSO Portal.

- Post scrutiny, the eligible applications will be forwarded online to the concerned bank.

- The bank will approve and disburse the loan in the given time period.

Scheme Benefits

- Beneficiaries will receive a loan to start their business.

- The loan will be provided in three phases.

- The loan will be provided for a maximum duration of 36 months.

- The government will provide a 7% grant on the loan interest rate.

- The loan provided is collateral-free.

| Phase | Loan Amount (in Rs) | Loan Tenure |

|---|---|---|

| Phase 1 | 10,000 | 12 Months |

| Phase 2 | 20,000 | 18 months |

| Phase 3 | 50,000 | 36 months |

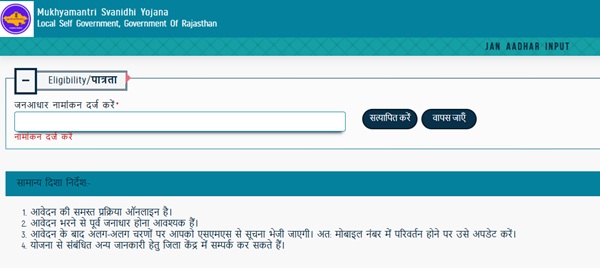

Eligibility Requirement

- The applicant must be a domiciled resident of Rajasthan.

- Age should be between 18 and 60 years.

- Must have a valid license/ Permit/ Letter of Recommendation (LOR) from the concerned department.

- Beneficiaries who are not entitled to the benefit of the PM Svanidhi Scheme.

Required Documents

- Janaadhaar Card.

- Aadhaar Card.

- Identity Proof.

- Address Proof.

- License/ Letter or Recommendation (LOR)

Steps to Apply

- The Rajasthan Mukhyamantri Svanidhi Yojana application form can be submitted online.

- Its online applications are available at the Rajasthan SSO Portal.

- Fill out the form carefully and share all mandatory details.

- Upload the required documents to their designated place in the given size and format only.

- Preview the duly filled-in application form before final submission.

- Once submitted, the application will be sent to the officials for verification.

- Post successful verification, the application will be forwarded to the concerned banks.

- After reviewing the applications, the bank will disburse the loan amount within the scheduled time.

Important Points

- The loan amount under the scheme will be credited to the applicant's bank account within two weeks.

- If the loan is not repaid within the allotted time, applicants need to pay a penalty as per banking rules.

- The account can only be closed after six months from the date of loan disbursal, if the loan amount is fully repaid.

- The interest subsidy will be credited to the applicant's bank account directly. The request will be made by the bank every six months.

Relevant Link

- Rajasthan Mukhyamantri Svanidhi Scheme Online Apply.

- Rajasthan Chief Minister Svanidhi Yojana Guidelines.

Contact Information

- Rajasthan Local Self Govt Department Phone Number: 0141-2226722

- Email Helpdesk: dlb.lsg@rajasthan.gov.in

Do you have any question regarding schemes, submit it in scheme forum and get answers:

Feel free to click on the link and join the discussion!

This forum is a great place to:

- Ask questions: If you have any questions or need clarification on any aspect of the topic.

- Share your insights: Contribute your own knowledge and experiences.

- Connect with others: Engage with the community and learn from others.

I encourage you to actively participate in the forum and make the most of this valuable resource.

Stay Updated

×

Add new comment