Highlights

- Collateral-free loan up to Rs 15 lakh for higher education studies.

Website

Customer Care

- Guruji Student Credit Card Scheme Helpline number: - 18005693311

- Guruji Student Credit Card Scheme Email Helpdesk: - nepdhte.jharkhand@gmail.com

Information Brochure

Summary of the Scheme | |

|---|---|

| Name of Scheme | Jharkhand Guruji Student Credit Card Scheme |

| Launch Year | 2024 |

| Benefits | Education Loan up to Rs 15 Lakh. |

| Beneficiary | 10th and 12th Pass Students of Jharkhand. |

| Nodal Department | Department of Higher and Technical Education. |

| Subscription | Subscribe Here to Get Update Regarding Scheme. |

| Mode of Apply | Through Guruji Student Credit Card Online Application Form. |

Scheme Introduction: A Brief Overview

- To encourage 10th and 12th pass students to pursue higher studies, the Jharkhand government has introduced an ambitious scheme called the "Guruji Student Credit Card Scheme".

- This scheme promises to provide education loans to economically weaker students without requiring any collateral.

- The loan amount can be used to pay institutional expenses, which include course fees, hostel charges.

- Similar to this scheme, the government has also introduced "Mukhyamantri Shiksha Protsahan Yojana".

- The loan under the Guruji Student Credit Card Yojana can only be used for higher education and diploma courses from a recognised institution.

- Students can avail of this loan at a nominal annual interest rate of 4%, which can be repaid within 15 years.

- Loans up to Rs 4 lakh will not incur any margin money, while loans above Rs 4 lakh will be charged a margin money of 5% of the total sanctioned loan amount.

- Students can use 70% of their loan amount for course fees and the remaining 30% for the hostel and food expenses.

- Domiciled students of Jharkhand who have completed their 10th and 12th grades from a recognised school within the state are eligible to apply.

- For diploma courses, students must have passed the 10th grade, while for undergraduate or higher courses, passing the 12th grade is mandatory.

- Applicants must be below 40 years of age, and must have secured admission to a listed institution either within or outside the state.

- These institutions must be ranked up to 200 in the overall NIRF category or up to 100 in their respective individual category.

- Additionally, these institutions must be accredited with a Grade 'A' or above by NAAC.

- Students will get a maximum of 15 years to repay this loan, including a one-year moratorium period after completing the course or after getting employment.

- Students who repay their loan upon the completion of their course will receive an additional benefit of 1% in loan interest.

- A total of 9 banks have been listed to provide these loans, which are

- HDFC Bank.

- Dhanbad Cooperative Bank.

- Bank of India.

- Jharkhand Rajya Gramin Bank.

- State Bank of India.

- ICICI Bank.

- Indian Bank.

- Axis Bank.

- Canara Bank.

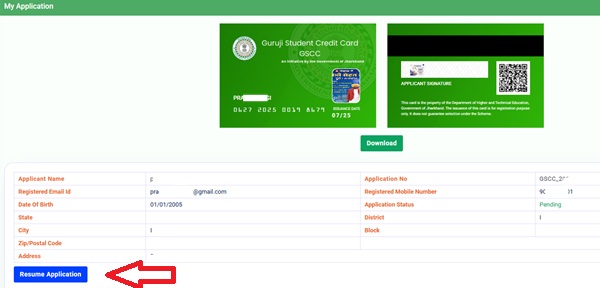

- An E-Card will be issued to students whose loan is approved by these banks.

- Loan provided under the Guruji Student Credit Card Yojana will be issued to these students with a zero processing fee.

- Interested students can apply for the Jharkhand Mukhyamantri Guruji Student Credit Card Yojana online.

- To receive these applications, a dedicated portal has been developed by the nodal department.

- The Department of Higher and Technical Education is the nodal department responsible for implementing the scheme.

Scheme Benefits

- Jharkhand Guruji Student Credit Card (GSCC) Scheme provides the following benefits to its beneficiaries: -

- Education loan of up to Rs 15 lakh for higher studies.

- The loan is provided at an interest rate of 4%.

- An additional 1% discount on interest if the loan is repaid during the course.

- No collateral required.

- Moratorium period of one year (after the course completion or after getting employment, whichever is earlier)

- The loan can be repaid within 15 years.

Eligibility Requirement

The benefit of the Jharkhand Mukhyamantri Guruji Student Credit Card Yojana can be availed by those who meet the following criteria as per the scheme guidelines: -

- The applicant must be a student and a domiciled resident of Jharkhand.

- The student's age at the time of applying for the loan should not exceed 40 years.

- Students must have completed: -

- 10th grade from Jharkhand (Diploma Course), or

- 10th and 12th grades from Jharkhand (for Undergraduate or Higher Courses)

- Students must secure admission to institutions such as IIT, IIM, IIEST, ISI, NLU, AIIMS, NIT, XLRI, IISc, BITS, SPA, NID, IIFT, or ICFAI Business Schools.

- The Institution must be ranked within the top 200 in the overall NIRF Category or within the top 100 in their specific category.

- The institution must also be accredited with Grade 'A' or above by NAAC.

- The students must not be a previous beneficiary of this scheme.

- The students must not have availed of any education loan from any cooperative bank for the course for which they have applied for under this scheme.

Required Documents

Students require the following documents while applying for the Guruji Student Credit Card online: -

Documents list Size (.jpeg/.jpg) Applicant's coloured photograph. 20 kb to 50 kb Applicant Signature 10 kb to 50 kb Aadhaar Card 50 kb to 400 kb High School Certificate 50 kb to 400 kb Intermediate Certificate 50 kb to 400 kb Institution admission fee receipt. 50 kb to 400 kb PAN Card 50 kb to 400 kb A prospectus issued by the institution with course fee details. 50 kb to 400 kb Coloured photograph of the co-applicant 20 kb to 50 kb Co-applicant signature 10 kb to 50 kb Co-applicant address proof. 50 kb to 400 kb

Steps to Apply

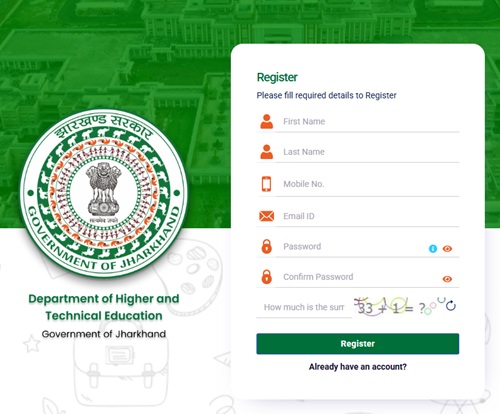

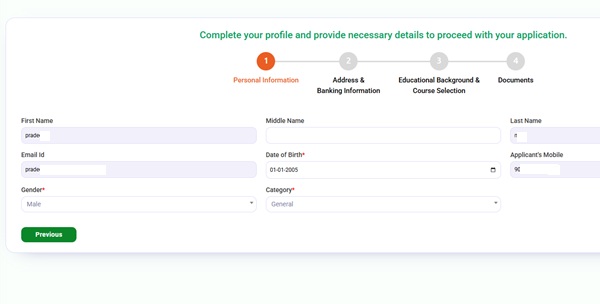

- Students can submit the Jharkhand Guruji Student Credit Card Yojana application online.

- For this, students need to visit the official portal of the Guruji Student Credit Card (GSCC).

- Select "Registration" from the home page.

- Provide the required details for registration.

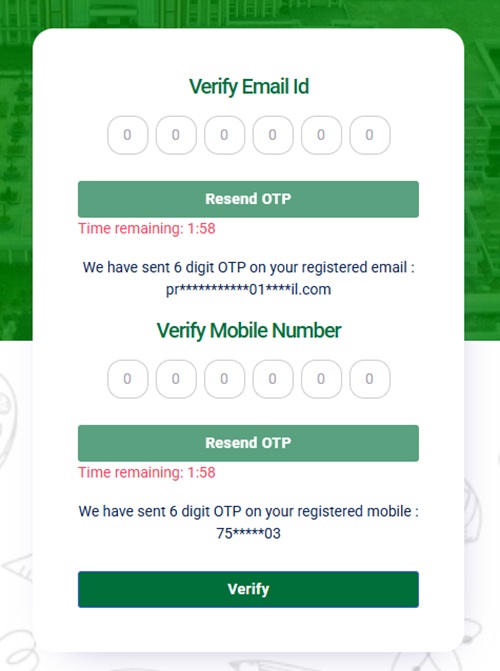

- For verification, submit the OTP received on the provided mobile number and Email ID.

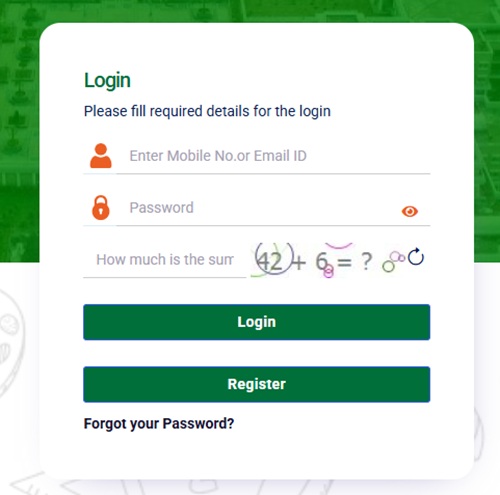

- Post registration, log in with your Mobile Number/Email ID and Password.

- Enter your Date of Birth, and upload your photo and signature.

- Select 'Resume Application' to continue the application process.

- Select your category and Gender to proceed.

- Now you have to provide your address and bank-related details.

- In the next step, share your education qualification and current institution details.

- At last, upload all your documents in the given size and format.

- Upon final submission, an application ID will be generated, which will help to check the application status.

- The concerned department will verify your application.

- If the submitted application is found correct bank will issue a loan to them.

Relevant Links

- Jharkhand Guruji Student Credit Yojana Application Link.

- Guruji Student Credit Card Yojana Applicant Login.

- Guruji Student Credit Card Notification.

- Guruji Student Credit Card Scheme Institutions List.

Loan Application Processing Queries Contact Number

| HDFC Bank | Suryanshu Kumar - 93040 03856 |

| Bank of India | Abhishek Srivastava- 95453 50900 |

| State Bank of India | Kumar Sumit - 99343 63702 |

| Jharkhand Rajya Gramin Bank |

|

| Dhanbad Central Cooperative Bank | Pushkar Bhagat - 96935 95573 |

| ICICI Bank | Ankit Kumar- 75468 57034 |

| Axis Bank | Ranadeep Dutta - 87770 40963 |

| Indian Bank | Bardan Nagduar - 93048 86075 |

Contact Information

- Guruji Student Credit Card Yojana Helpline Number: - 18005693311

- Guruji Student Credit Card Yojana: - nepdhte.jharkhand@gmail.com

- Department of Higher and Technical Education,

3rd Floor, Yojna Bhawan,

Nepal House, Doranda,

Ranchi-834002

Do you have any question regarding schemes, submit it in scheme forum and get answers:

Feel free to click on the link and join the discussion!

This forum is a great place to:

- Ask questions: If you have any questions or need clarification on any aspect of the topic.

- Share your insights: Contribute your own knowledge and experiences.

- Connect with others: Engage with the community and learn from others.

I encourage you to actively participate in the forum and make the most of this valuable resource.

Stay Updated

×

Add new comment