.

1800-180-1111

Standup India is an initiative that was launched by Prime Minister of India, Narendra Modi on 5 April 2016. The scheme was introduced for supporting entrepreneurship among women and SC/ST communities. It is anchored by Department of Financial Services(DFS), Ministry of Finance, Government of India.

In this initiative, bank loans of Rs 10 lakh to Rs1 crore is offered to women and Scheduled Castes and Scheduled Tribes for setting up new enterprises outside of the farm sector.

Are you eligible to apply for scheme: -

- SC/ST or women entrepreneurs who attained the age of 18 years.

- Under this scheme loan is available only for Greenfield project. In this context, Greenfield signifies , beneficiary's first time venture in the manufacturing or trading or services sector.

- 51 per cent of the shareholding and controlling stakes should be held by either SC/ST and/or Women Entrepreneur.

- Borrower should not be in default to any bank or financial institution.

Characteristics of Loan : -

| 1 | Type of loan | It is a type of composite loan which covers term loan and working capital from Rs 10 lakh to Rs 1 crore. |

| 2 | Size of Loan | 75 per cent composite loan of the project cost inclusive of term loan and working capital. If the borrower's contribution along with convergence support from any other schemes exceeds 25% of the project cost. |

| 3 | Rate of Interest | Interest rate would be lowest applicable rate of the bank for the category(rating category) not to exceed (base rate(MCLR) + 3% + tenor premium). |

| 4 | Security | Besides primary security, the loan may be secured by collateral security or guarantee of Credit Guarantee Fund Scheme for Stand-Up India Loans (CGFSIL) as decided by the banks. |

| 5 | Repayment | 7 years is the repayable period for the loan with a maximum moratorium period of 18 months. |

| 6 | Margin Money | The Scheme contemplates 25% margin money which can be provided in convergence with eligible Central / State schemes. The borrower shall be required to bring in minimum of 10% of the project cost as own contribution in all cases. |

| 7. | Working Capital | Working capital upto 10 lakh can be drawn by way of overdraft. For convenience of borrower rupay debit card is to be issued. Working capital limit above 10 lakh to be sanctioned by way of Cash Credit limit. |

Documents needed to apply for loan under Standup India scheme:

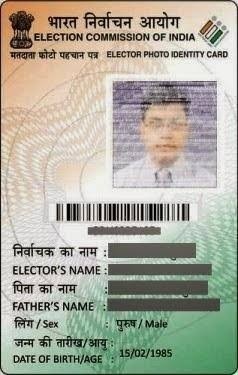

- Identity proof : -

- Voter’s ID Card

- Passport

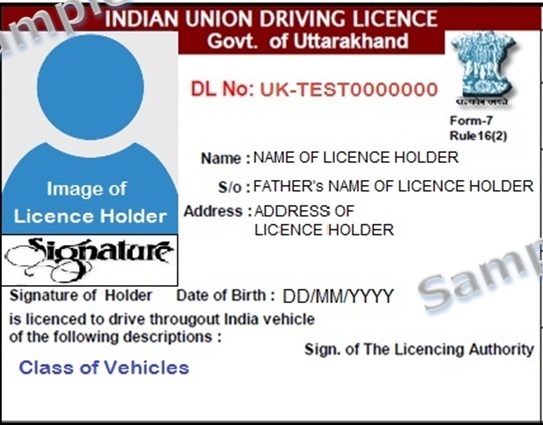

- Driving License

- PAN Card

- Signature identification from present bankers of proprietor, partner of director ( if a company)

- Voter’s ID Card

- Residence proof : -

- Recent telephone bills

- property tax receipt

- Passport

- electricity bill,

- voter’s ID Card of Proprietor, partner of Director (if a company)

- Proof of business Address.

- Memorandum and articles of association of the Company / Partnership Deed of partners etc.

- Assets and liabilities statement of promoters and guarantors along with latest income tax returns.

- SSI / MSME registration if applicable.

- Rent Agreement (if business premises on rent) and clearance from pollution control board if applicable.

- Projected balance sheets for the next two years in case of working capital limits and for the period of the loan in case of term loan.

- Photocopies of lease deeds/ title deeds of all the properties being offered as primary and collateral securities.

- Documents to establish whether the applicant belongs to SC/ST Category, wherever applicable.

- Certificate of incorporation from ROC to establish whether majority stake holding in the company is in the hands of a person who belongs to SC/ST/Woman category.

- In cases of Exposure above Rs 25 lakhs: -

- Profile of the unit (includes names of promoters, other directors in the company, the activity being undertaken addresses of all offices and plants, shareholding pattern etc.

- Last 3 years balance sheets of the Associate / Group Companies (if any).

- Manufacturing process if applicable, major profile of executives in the company, any tie-ups, details about raw material used and their suppliers, details about the buyers, details about major-competitors and the company’s strength and weaknesses as compared to their competitors etc.

- Project report (for the proposed project if term funding is required) containing details of the machinery to be acquired

- from whom to be acquired,

- price,

- names of suppliers,

- financial details like capacity of machines,

- capacity of utilization assumed,

- production, sales,

- projected profit and loss and balance sheets for the tenor of the loan,

- the details of labour,

- staff to be hired, basis of assumption of such financial details etc.

The check list is only indicative and not exhaustive and depending upon the local requirements at different places addition could be made as per (necessity).

How to apply for loan?

- The scheme covers all branches of scheduled commercial banks. It can be accessed in 3 ways:

- By visiting directly to bank branch

- By registering online through SIDBI Stand up India Portal www.standupmitra.in

- Through the Lead District Manager

- Information on certain parameters/ metrics of the borrower (obtained through a set of about 8-10 questions listed below) is collected through the initial registration process in the portal. Based on the information provided, feedback is provided to borrowers.

- At the initial stage the approach of the stand-up India portal for handholding is based on obtaining answers to set of relevant questions. The following are the questions :

- Location of the borrower

- Category – SC/ ST/ Woman

- Availability of place to operate the business.

- Assistance needed for preparing a project plan

- Requirement of skills/training (technical and financial).

- Nature of business planned

- Amount of own investment into the project

- Details of present bank account.

- Whether help is needed to raise margin money

- Any previous experience in business

- The borrowers are categorized as a ready borrower or a trainee borrower based on the response: -

- Trainee Borrower : If the borrower indicates a need for handholding, after registering as a Trainee Borrower on the Stand-Up India portal (www.standupmitra.in) borrower will be linked to the Lead district manager and relevant office of SIDBI/NABARD. Borrower will be provided support for : -

- For financial training - at the Financial Literacy Centres (FTCs).

- For skill training at skill training centres (Vocational Training Centres - VTPs/Other Centres -OCs).

- For work shed -DICs.

- For EDPs - at MSME DIs/District Industries Centres(DICs)/ Rural Self Employment Training Institutes( RSETIs).

- For utility connections – Offices of utility providers

- For DPRs – Project profiles available with SIDBI/ NABARD/ DICs

- For margin money – State SC Finance Corporation, Women’s Development Corporation, State Khadi & Village Industries Board (KVIB).

- A loan application will be generated through the portal. Once hand holding requirements are adequately met to the satisfaction of the LDM and the trainee borrower.

- Ready Borrower -If the borrower does not require any handholding support, then the application process for the loan at the selected bank can be done through Stand-Up India portal . At this stage an application number will be generated and information about the borrower shared with the bank concerned, the LDM and relevant linked office of NABARD/SIDBI. Then the loan application will now be generated and tracked through the portal.

- Trainee Borrower : If the borrower indicates a need for handholding, after registering as a Trainee Borrower on the Stand-Up India portal (www.standupmitra.in) borrower will be linked to the Lead district manager and relevant office of SIDBI/NABARD. Borrower will be provided support for : -

Contact details : -

- Email - support@standupmitra.in , help@standupmitra.in .

- National Helpline Toll-Free Number : 1800-180-1111

- Website : www.standupmitra.in

| Person Type | Govt |

|---|---|

Stay updated with the latest information about Standup India Scheme

Comments

Agricultural kit nashan Dba

Loans provide

Add new comment