Highlights

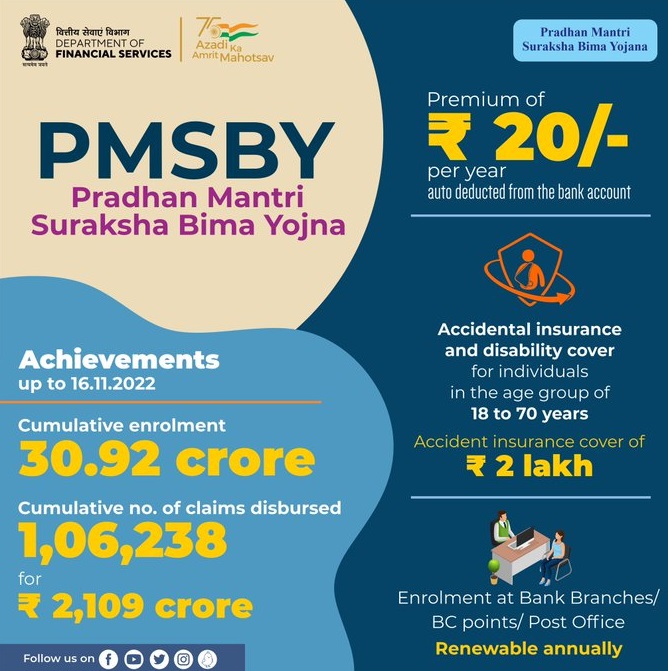

- Personal Accidental Insurance Cover Of Rs. 1,00,000/- to Rs. 2,00,000/-

- Rs. 2 Lakh in Case of Death.

- Rs. 2 Lakh in Case of Permanent Disability.

- Rs. 1 Lakh in Case of Partial Disability.

- Minimum Yearly Premium Of Rs. 20/-.

Website

Customer Care

- Pradhan Mantri Suraksha Bima Yojana National Toll Free Number :-

- 18001801111.

- 1800110001.

Information Brochure

|

Overview Of The Scheme

|

|

|---|---|

| Name of Scheme | Pradhan Mantri Suraksha Bima Yojana (PMSBY) |

| Launched Date | 1st of June 2015. |

| Scheme Type | Accidental Insurance Scheme. |

| Nodal Ministry | Department of Financial Services. |

| Official Website | Jan-Dhan se Jan Suraksha Portal. |

| Accidental Insurance | Rs. 1,00,000/- to Rs. 2,00,000/-. |

| Premium To Be Paid | Rs. 20/- Every Year. |

| Insurance Time Period |

|

| Eligibility | Every Indian Citizen Between the Age Group Of 18 to 70 Years. |

| Mode Of Apply | Offline/ Online Mode Available Through Banks. |

Introduction

- Pradhan Mantri Suraksha Bima Yojana is a Accidental Insurance Scheme run by Indian Government.

- Department of Financial Services under the Ministry Of Finance is the nodal department of this scheme.

- It was launched on 1st Of June 2015.

- The main objective behind starting Pradhan Mantri Suraksha Bima Yojana is to provide personal accidental insurance cover to unisured people.

- This scheme is also know by other name i.e. :- "Pradhan Mantri Suraksha Bima Scheme" or "Prime Minister Social Security Scheme" or "Prime Minister Accidental Insurance Scheme".

- It is a one year personal accidental insurance cover for a person.

- Financial Assistance will be provided to Insured Person on his/her death caused due to accident or he/she suffered partial/ permanent disability of Eyes/ Hand/ Feet.

- Rs. 2,00,000/- will be provided under Pradhan Mantri Suraksha Bima Yojana in case of Death of a Policy Holder.

- Whereas, Financial Assistance of Rs. 2,00,000/- will be provided in case of Permanent Disability and Rs. 1,00,000/- will be provided in case of Partial Disability caused due to accident.

- Premium of Rs. 20/- per year will have to paid by the beneficiary in order to avail the personal accidental cover under Pradhan Mantri Suraksha Bima Yojana.

- This scheme is offered by Public Sector General Insurance Companies (PSGICs) and other General Insurance Companies having collaboration with Banks.

- It is up to Concerned Banks to engage any Insurance Company to implement Pradhan Mantri Suraksha Bima Yojana for their customers.

- Eligible Beneficiary can enrol themselves in Pradhan Mantri Suraksha Bima Yojana by visiting the bank.

- Officials present at the bank will registered the beneficiary person in Pradhan Mantri Suraksha Bima Yojana.

- It depends on Bank whether they choose Online Application Process or Offline Application Process to register beneficiary in Pradhan Mantri Surksha Bima Yojana.

Benefits

- Personal Accidental Insurance Cover from Rs. 1,00,000 to Rs. 2,00,000/-.

- The Amount of Premium is very minimal i.e just Rs. 20/- per year.

- Covers Death Caused due to Accident or Partial/ Permanent Disability of a Person due to Accident.

- Premium is auto-debited from Account Holder's Bank Account on Consent.

- Financial Assistance provided under Pradhan Mantri Suraksha Bima Yojana are :-

Situation of Benefit Amount Of

InsuranceDeath of Policy Holder Rs. 2,00,000/- - Any Complete Disability :-

- Total and Irrecoverable Loss Of Both Eyes.

- Loss Of Use Of Both Hands Or Both Feet.

- Loss Of Sight Of One Eye.

- Loss Of Use Of Hand Or Foot.

Rs. 2,00,000/- - Partial Disability :-

- Total and Irrecoverable Loss Of Sight Of One Eye.

- Loss of Use Of One Hand Or One Foot.

Rs. 1,00,000/- - Any Complete Disability :-

Eligibility Criteria

- Every Indian Citizen in the Age Group of 18 Years to 70 Years are Eligible for Pradhan Mantri Suraksha Bima Yojana.

- Beneficiary should have a Jandhan Bank Account or Saving Bank Account in any Bank.

- Bank Account should be linked with the Person's Aadhar Number.

Key Features Of The Scheme

- It is a social security scheme for all Indians but especially focuses on uninsured poor and under privileged persons.

- Life Insurance Cover is only for 1 year starting from 1st of June to 31st of May every year.

- The annual renewal date of the scheme is 1st of June in every upcoming year.

- On consent from the policy holder, the amount of premium i.e. Rs. 20/- will be deducted through auto-debit mode from policy holder's account in a single instalment.

- Any person who exited the scheme at any point of time can join again the scheme in near future.

- A person who crosses the age of 70 years cannot register himself under Pradhan Mantri Suraksha Bima Yojana.

- It is mandatory to link person's Aadhar Card with his/her Bank Account.

- Beneficiary can register themselves in Pradhan Mantri Suraksha Bima Yojana through by filling application form in the Bank branch at any time in the year.

- Some Banks also gave facility to their customers to apply online for Pradhan Mantri Suraksha Bima Yojana.

- In case of death of a policy holder, the nominee can receive the amount of Rs. 2 Lac.

- If any person has multiple bank accounts then in that case he/she can avail the benefit of the scheme from only single bank account of himself/herself.

Conditions In Which No Claim Will Be Payable

- Beneficiary can not able claim for accidental insurance amount under Pradhan Mantri Suraksha Bima Yojana if he/ she falls within the ambit of any of the below mentioned conditions :-

- When beneficiary attained the age of 70 Years.

- Insufficient balance in the Bank Account for Premium Deduction.

- Closure of Bank Account by Beneficiary.

- When any person avail the benefit of same scheme through multiple bank accounts.

Application Forms

- Application/ Enrolment Form of Pradhan Mantri Suraksha Bima Yojana according to the specific State Language are as follows :-

Claim Forms

- Claim Forms of Pradhan Mantri Suraksha Bima Yojana according to the languages of the State are :-

Important Links

- Jan-Dhan se Jan Suraksha Portal.

- Department Of Financial Services.

- Ministry Of Finance.

- Pradhan Mantri Suraksha Bima Yojana Guidelines.

- Pradhan Mantri Suraksha Bima Yojana FAQs.

National Toll Free Numbers

- 18001801111.

- 1800110001.

| JAN-SURAKSHA-StateWise Toll Free Numbers | ||

|---|---|---|

| State Name | Name Of Convenor Bank | Toll Free Number |

| Andhra Pradesh | Andhra Bank | 18004258525 |

| Andaman & Nicobar Island |

State Bank Of India | 18003454545 |

| Arunachal Pradesh | State Bank Of India | 18003453616 |

| Assam | State Bank Of India | 18003453756 |

| Bihar | State Bank Of India | 18003456195 |

| Chandigarh | Punjab National Bank | 18001801111 |

| Chhattisgarh | State Bank of India | 18002334358 |

| Dadra & Nagar Haveli | Dena Bank | 1800225885 |

| Daman & Diu | Dena Bank | 1800225885 |

| Delhi | Oriental Bank of Commerce | 18001800124 |

| Goa | State Bank of India | 18002333202 |

| Gujarat | Dena Bank | 1800225885 |

| Haryana | Punjab National Bank | 18001801111 |

| Himachal Pradesh | UCO Bank | 18001808053 |

| Jharkhand | Bank of India | 18003456576 |

| Karnataka | Syndicate Bank-SLBC | 180042597777 |

| Kerala | Canara Bank | 180042511222 |

| Lakshadweep | Syndicate Bank | 180042597777 |

| Madhya Pradesh | Central Bank of India | 18002334035 |

| Maharashtra | Bank of Maharashtra | 18001022636 |

| Manipur | State Bank of India | 18003453858 |

| Meghalaya | State Bank of India | 18003453658 |

| Mizoram | State Bank of India | 18003453660 |

| Nagaland | State Bank of India | 18003453708 |

| Odisha | UCO Bank | 18003456551 |

| Puducherry | Indian Bank | 180042500000 |

| Punjab | Punjab National Bank | 18001801111 |

| Rajasthan | Bank of Baroda | 18001806546 |

| Sikkim | State Bank of India | 18003453256 |

| Telangana | State Bank of Hyderabad | 18004258933 |

| Tamil Nadu | Indian Overseas Bank | 18004254415 |

| Uttar Pradesh | Bank of Baroda | 18001024455 |

| 1800223344 | ||

| Uttarakhand | State Bank of India | 18001804167 |

| West Bengal and Tripura | United Bank of India | 18003453343 |

Ministry

Do you have any question regarding schemes, submit it in scheme forum and get answers:

Feel free to click on the link and join the discussion!

This forum is a great place to:

- Ask questions: If you have any questions or need clarification on any aspect of the topic.

- Share your insights: Contribute your own knowledge and experiences.

- Connect with others: Engage with the community and learn from others.

I encourage you to actively participate in the forum and make the most of this valuable resource.

Stay Updated

×

Comments

bank wale bole ye jaruri hai…

bank wale bole ye jaruri hai lena kya ye jaruri hai lena

Zaruri nhi hai ye voluntary…

Zaruri nhi hai ye voluntary hai

r u kidding sach me 12 rs…

r u kidding sach me 12 rs hai premium iska??

which corporation provide…

which corporation provide the service for this scheme

Dear govtschemes.in…

Dear govtschemes.in webmaster, Thanks for the well-researched and well-written post!

koi online portal hai iske…

koi online portal hai iske liye apply krne ke liye?

हल्दुपाडा

मकान

Hindi

Sir me single hu or mujhe pese ki zarurat hai or me job bhi karta hu or usse itna ni ho pata ki me pese jodh saku sir me ane wale 5sal me sadi karunga.

Add new comment