Highlights

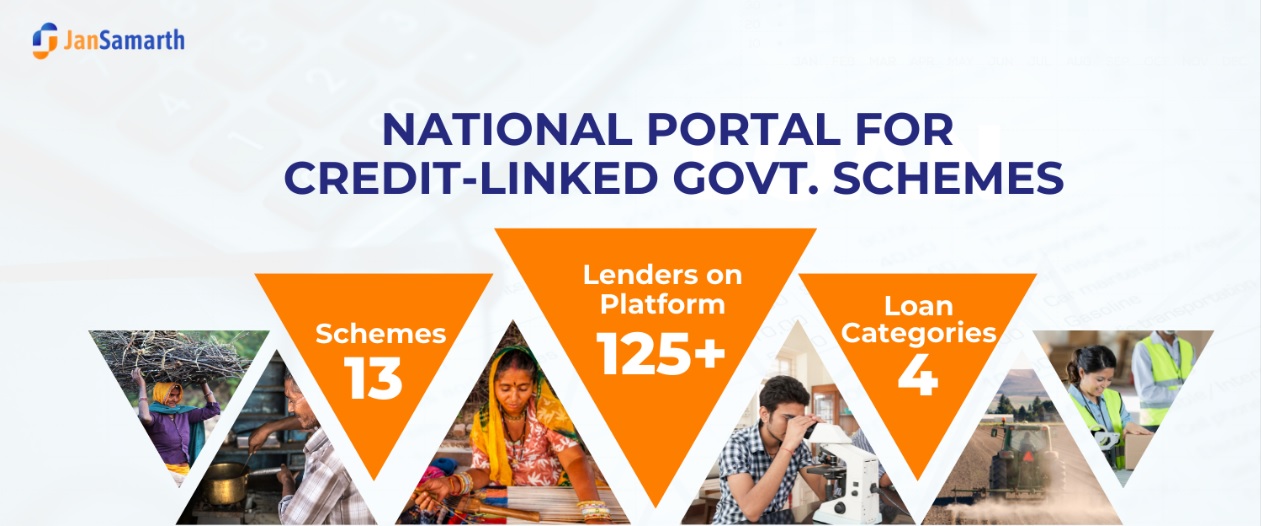

- 4 Loan Categories to Apply.

- 13 Schemes in One Portal.

- More than 125 Lenders Available to Grant Loan

Website

Customer Care

- For Borrower :-

- Email :- Customer.support@jansamarth.in.

- Phone Number :- 079 69076111.

- For Bank and Others :-

- Email :- Bank.support@jansamarth.in.

- Phone :- 079 69076123.

|

Overview Of The Scheme

|

|

|---|---|

| Name of Scheme | JanSamarth Portal - A Unique One Stop Digital Portal. |

| Launched On | 06-06-2022. |

| Objective | To provide a single platform for credit linked government schemes. |

| Official Website | JanSamarth Portal. |

Introduction

- JanSamarth Portal is a one of its kind digital portal launched by Government of India.

- It was launched on 06-06-2022.

- Through this portal a beneficiary can avail the benefit of the schemes at one place.

- At present in this portal a total of thirteen credit linked government schemes are available.

- Out of which :-

- 3 scheme is for Educational Loan.

- 3 scheme is for Agri Infrastructure Loan

- 6 scheme is for Business Activity Loan.

- And 1 scheme is for Livelihood Loan.

- Beneficiary can digitally check their eligibility before apply online under any of the eligible scheme.

- This portal is directly connect lender with borrowers.

- In this portal beneficiary have to answer few questions and he found all the suitable schemes for him/her.

- Thereafter fill all the basic details, upload all the required documents.

- More than 125 lenders will be availabe to provide a loan to beneficiary.

- After selecting the lender bank, the beneficiary get digital approval of his/her loan.

Loans Available on Portal

- At present there are 4 types of loan category available on this portal.

- These Categories are :-

- Further these categories are elaborated as below :-

Education Loan 1.Central Sector Interest Subsidy (CSIS) - Introduction :-

- Central Sector Interest Subsidy Scheme is an education loan scheme of Ministry of Education.

- This scheme is only available for students belongs to economically weaker sections.

- Eligible students can take subsidise loan to pursue Technical or Professional education within India .

- Eligibility :-

- All the students whose annual family income does not exceed to Rs. 4.5 lakhs per annum.

- Students who want to pursue Technical or Professional Courses within India.

- Benefit of the Scheme :-

- No collateral security required.

- No third party guarantee.

- Subsidy benefit available for course period+one year.

- The subsidy amount will be on maximum Rs. 10 lakh loan amount.

- List of approved institution :-

2. Padho Pradesh (Padho Pardesh) - Introduction :-

- Padho Pardesh is an interest subsidy on an education loan for those students who want to pursue their studies outside India.

- This interest subsidy is only available once to students.

- 35 % seats of this scheme is reserved for girls students.

- Eligibility :-

- Students belongs to six notified minority community.

- Interest subsidy is only for those students who get enrolled in Masters, M. Phil or in Ph.D. courses.

- Students should have to take admission in approved courses.

- Loan should be availed from a schedule bank.

- Benefit can only be taken during 1st year of the course.

- Total annual income should not exceed to Rs. 6.00 lakh per annum.

- Additional Information :-

- Interest subsidy is available on loans sanctioned up to maximum of Rs. 20.00 lakhs.

- Subsidy benefit is available for course period+1 year.

- Income certificate is mandatory to submit every year.

3. Dr. Ambedkar Central Sector Scheme. - Introduction :-

- Dr. Ambedkar Central Sector Scheme is an interest subsidy scheme on educational loan for overseas studies.

- It's main objective is to promote higher education on Other Backward Class (OBC) and Economically Backward Class (EBCs) students.

- The scheme is only for those students who want to pursue their higher education outside India.

- Eligibility :-

- Only Other Backward Class (OBC) and Economically Backward Class (EBC) students are eligible.

- Students who pursue Masters, M. Phil or Ph.D. from abroad.

- Loan should be availed form Schedule Bank.

- OBC certificate should be in prescribed performa.

- Total annual income of Other Backward Students candidate should not exceed to Rs. 8 lakhs per annum.

- Total annual income of Economically Backward Students should not exceed to Rs. 5 lakh per annum.

- Additional Information :-

- This scheme is run by Ministry of Social Justice and Empowerment.

- 50% of the total allocation is reserved for female students.

- Interest subsidy is available on loans sanctioned up to maximum of Rs. 20.00 lakhs.

- Subsidy benefit is available for course period+1 year.

- Income certificate is mandatory to submit every year.

Agri Infrastructure Loan 1. Agri Clinics And Agri Business Centres Scheme (ACABC) - Introduction :-

- Agri Clinics and Agri Business Centres Scheme (ACABC) is run by Ministry of Agriculture and Farmers' Welfare.

- It's objective is to support effort of public extension, support agriculture development and to create self employment opportunities for unemployed agriculture graduates/post graduates.

- Agri Clinics provide expert advice to farmers on different issues like :- soil health, crop practice, crop insurance, plant protection,clinical services for animals, price of various crops in the market.

- Agri Business Centres are the set up of unemployed trained agriculture professionals.

- 44% project cost subsidy will be provided to women, SC/ST and all candidates from North Eastern and Hill States.

- 36% project cost subsidy is for all others.

- Eligibility :-

- Candidates who have completed their training through National Institute of Agriculture Extension (MANAGE).

- Unemployed agriculture graduates graduated in subject like Horticulture, Animal Husbandry, Forestry, Dairy, Veterinary, Poultry Farming and Sericulture.

- Post Graduates in agriculture and allied subjects.

- Diploma/ Degree in agriculture and allied subjects.

- Agriculture related courses at 12th class level.

- Additional Information :-

- Age limit is 18 to 60 years.

- No retired official is eligible under this scheme.

- Eligible ceiling cost for subsidy is Rs. 20 lakhs for individual project.

- Ceiling cost for group project is Rs. 100 lakh.

- For successful individual project the ceiling cost is Rs. 25 lakhs.

- Graduates from agriculture background will be given free of cost training.

2. Agricultural Marketing Infrastructure (AMI). - Introduction :-

- Agriculture Marketing Infrastructure is a central government backed scheme to promote agriculture marketing infrastructure projects for reducing the involvement of minimizing post-harness losses.

- It's main objective is to develop storage infrastructure, to promote latest technologies, etc.

- Marketing Infrastructure projects are cleaning, grading, sorting, packaging, and value addition activities like Mini Oil Expeller, Mini Dal Mill, and Development of Rural Haats.

- Eligibility :-

- Farmers

- Group of Farmers/Growers.

- Local Bodies.

- Panchayats

- partnership/Proprietary Firms

- Company

- NGOs etc.

- Additional Information :-

- For storage infrastructure, the storage capacity should be 50 to 5000 Metric Tonne for promoters and 50 to 10000 Metric Tonne for State Agencies are eligible for claiming subsidy.

- Promoter's contribution should be minimum 20% to maximum 50% of the project cost.

- For North Eastern States, Sikkim UTs of Andaman & Nicobar and Lakshadweep Island and Hilly Areas, the subsidy amount is 33% of project cost.

- For Registered FPOs, Panchayats, Women, Schedule Caste (SC)/ Schedule Tribe (ST)Entrepreneurs, Self Help Groups, the subsidy amount is 33% of project cost.

- For all other beneficiaries, the subsidy amount is 25% of the project cost.

3. Agriculture Infrastructure Fund. - Introduction :-

- Agriculture Infrastructure Fund is a long term financial assistance for building infrastructure for post harvest stage.

- Through this farmers will able to sell their produce in the market with reduced post harvest losses.

- Eligibility :-

- Primary Agriculture Credit Societies (PACS).

- Marketing Cooperative Societies.

- Farmers.

- Self Help Group (SHG).

- Farmer Producers Organization (FPOs).

- Joint Liability Group etc.

- Additional Information :-

- Improved marketing infrastructure allows farmer to sell their produce directly.

- All loans have interest subvention of 3% per annum up to a limit of Rs. 2 crore.

- The subvention will be available only for 7 years.

- Moratorium period of the scheme is minimum six month and maximum 2 years.

Business Activity Loan 1. Prime Minister's Employment Generation Programme (PMEGP). - Introduction :-

- Prime Minister Employment Generation Programme is administered by Ministry of Micro, Small and Medium Enterprises (MoMSME).

- Scheme is implemented by Khadi and Village Industries Commission.

- It is a subsidy program for setting up new micro enterprises in non-farm sector.

- Subsidy on Bank Loan from 15% to 35% is given for projects up to Rs 50 Lakh in manufacturing and Rs. 20 Lakh in service sector.

- For Schedule Caste (SC)/ Schedule Tribes (ST)/ Women/ PH/ Minorities/ Ex Servicemen/ North Eastern Region, the subsidy is 35% in rural areas and 25% in urban areas.

- Eligibility :-

- Age should be above 18 years.

- There is no income ceiling.

- No educational qualification is required for project cost up to Rs 10 lakh in manufacturing and up to Rs. 5 lakh in service sector.

- Units already availing government subsidy are not eligible under this scheme.

- Additional Information :-

- This scheme is implemented to create employment opportunities.

- Through this scheme the wage earning capacity are also increase.

2. Weaver Mudra Scheme (WMS) - Introduction :-

- Weaver MUDRA Scheme provides financial assistance to handloom weavers through weaver's credit card or term loan.

- Financial assistance is provided for working capital and purchase of tools and equipment.

- Eligibility :-

- Handlooms Weavers involved in weaving activity.

- Weaver Entrepreneur.

- Self Help Groups, Joint Liability Group.

- Primary Handloom Weavers.

- Apex Handloom Weavers.

- Producer Companies.

- Additional Information :-

- Money Support up to Rs. 42,000/- per weaver.

- Interest Subsidy up to 3% on bank loan.

- Reimbursement of 1 time guarantee fees.

- Maximum loan amount is Rs. 2 lakhs.

- No collateral required.

- Repayment period is 3 years.

3. Pradhan Mantri MUDRA Yojana (PMMY) - Introduction :-

- Pradhan Mantri Mudra Yojana is a scheme to provide loans to non-cooperate, non farming small and micro enterprises.

- There are three categories under this scheme.

- First category is Shishu in which loan amount of up to Rs 50,000/- will be provided.

- Second category is Kishore in which loan from Rs. 50,001 to Rs. 5 Lakh will be provided.

- And the last category is Tarun in which loan from Rs. 5,00,001 to Rs. 10 lakhs will be provided.

- Mudra loans will be provided for Trading, Manufacturing and for services sector.

- Eligibility :-

- Individuals.

- Proprietary Concern.

- Partnership Firm.

- Private Limited Company.

- Public Company.

- Any other Entities.

- Applicant should not be a defaulter of any bank.

- Additional Information :-

- No collateral required.

- There is no subsidy for the loan given under Prime Minister Mudra Yojana.

4. Pradhan Mantri Street Vendor Aatmanirbhar Nidhi Scheme (PM SVANidhi) - Introduction :-

- Prime Minister Street Vendor AtmaNirbhar Nidhi (PM SVANidhi)is a micro credit facility launched to provide affordable loans to street vendors.

- No collateral required up to the working capital loans of Rs. 10,000/- for 1 year tenure.

- Interest subsidy on time repayment is 7%.

- Rs. 100/- cash back on digital transactions.

- If first loan repaid timely, then the loan eligibility will be increases to Rs. 20,000/- and further to Rs. 50,000/-.

- Eligibility :-

- Street Vendor who is in possession of Certificate of Vending.

- Vendors identifies in the survey by Urban Local Body.

5. Self Employment Scheme for Rehabilitation of Manual Scavengers (SRMS) - Introduction :-

- This scheme is implemented to rehabilitate the manual scavenger and their dependents in other occupation.

- Eligibility :-

- Manual Scavengers identified by State Governments.

- Sanitation Workers and their dependents are only eligible for assistance for self employed projects.

- Benefits :-

- One time cash assistance of Rs. 40,000/- to one scavenger per family.

- Skill development training for up to 2 years with stipend of Rs.3,000/- per month.

- Subsidized Loans for self employment projects.

- Additional Information :-

- Maximum Loan repayment period is 5 years for project up to Rs. 5 lakh.

- Maximum Loan repayment period is 7 years for project more than Rs. 5 lakhs.

6. Stand Up India Scheme (StandUpIndia) - Introduction :-

- Stand Up India Scheme is a scheme to facilitate bank loans to Schedule Caste (SC)/ Schedule Tribes (ST)and Women Entrepreneurs for setting Greenfield Projects.

- Green Field is a First-Time venture of the beneficiary.

- Working Capital loans between Rs 10 lakh to 1 Crore will be provided under this scheme.

- Tenure of loan is 7 years.

- Maximum moratorium period is 18 months.

- Eligibility :-

- SC/ST and Women Entrepreneurs.

- Enterprises must be in manufacturing, services, agri-allied activities or in the trading sector.

- If there is a partnership firm then 51% of the shareholding should be holded by SC/ST or Women Entrepreneur.

- Additional Information :-

- There is no collateral security require for the loans.

- Repayment period of loan is 7 years.

Livelihood Loan 1. Deendayal Antyodaya Yojana-National Rural Livelihoods Mission (DAY-NRLM) - Introduction :-

- Deendayal Antyodaya Yojana - National Rural Livelihoods Mission (DAY-NRLM) is a poverty elimination schemes runs by Ministry of Rural Development.

- The main objective of this scheme is to covert 8 to 10 crore poor people into Self Help Groups (SHGs) in aphased manner.

- This also increase their income and improves the quality of life.

- Eligibility :-

- Self Help Groups should be active at least since the last 6 months.

- Self Help Group should do Regular Meetings, Regular Savings, Regular Inter-Loaning, Timely Repayment, and Up to date books of accounts.

- Qualified as per the grading norms fixed by NABARD.

- Additional Information :-

- No collateral is required for loans up to Rs 10 lakhs to Self Help Groups.

- Self Help Group can apply for term loan or cash credit limit.

- Introduction :-

Document required

- Each scheme has different documentation required.

- But the basic required document is :-

- Aadhaar Number.

- Voter ID.

- PAN Card.

- Bank Statement.

How to Apply

- First Beneficiary have to check his/her eligibility by taking simple steps.

- Out of 4 loan categories i.e. Education Loan, Agri Infrastructure Loan, Business Activity Loan, and Livelihood Loan, beneficiary have to choose check eligibility by choosing his/her category.

- For checking eligibility, the required fields are :-

Category Required Fields for Checking the Eligibility. Educational Loans - Select the location of study :- Within India or Outside India.

- Enter Gross Family Annual Income.

- Choose Social Category :- Whether General, OBC, SC/ST or Minority.

- Select the Course :- Graduate, Post Graduate, Doctorate, Other.

- Duration of the Course.

- Type of the Course :- Full Time, Part Time, Distance Learning or Other.

- Course Fees.

- Amount Invested By Beneficiary.

- Then after clicking on Calculate eligibility, portal shows each and every scheme for whom a person eligible for.

Agri Infrastructure Loan - Select the nature of the business :- Individual or Non-Individual.

- Choose Gender.

- Select Social Category :- Whether General, SC/ST, OBC, Minority.

- Click on Yes if Beneficiary is a resident of Northeastern Region/ States of Uttarakhand, Himachal Pradesh, Jammu and Kashmir, Andaman and Nicobar Island, Lakshadweep Island, Hilly Areas or Tribal Areas.

- Choose the Purpose of the Loan

- Enter the Project Cost.

- Enter the Amount Invested by the Beneficiary.

- Then after clicking on Calculate eligibility, portal shows each and every scheme for whom a person eligible for.

Business Activity Loan - To check the eligibility for available schemes, beneficiary have to choose one of the 4 categories mentioned in the portal :-

1. Loan for Handloom Weaver.

2. Loan for Manual Scavenger.

3. Loan for Street Vendors

4. Other Business Loan - After choosing one of the category, beneficiary have to fill required details about the business.

- Then after clicking on Calculate eligibility, portal shows each and every scheme for whom a person eligible for.

Livelihood Loan - Select from the given option whether beneficiary belongs to Self Help Group or an Individual.

- After choosing, fill all the required details and click on check eligibility.

- After clicking portal shows each and every scheme for whom a person eligible for.

- Thereafter beneficiary has to register himself/herself on the portal.

- Beneficiary can register himself/herself by their phone number and Email ID

- First enter the mobile number and the portal will verify it by sending OTP.

- After mobile number got verified, beneficiary has to enter their Email ID.

- An OTP is sent by the portal to beneficiaries Email ID for verification.

- After Email verification, beneficiary have to choose password for Log in.

- After choosing password, beneficiary will get entered into the portal and the list of all the schemes are visible.

- According to his/her eligibility, the beneficiary can select the scheme and avail the benefit.

List Of Partner Banks

|

Important Links

- JanSamarth Portal.

- All Schemes of JanSamarth Portal.

- New Registration on JanSamarth Portal.

- JanSamarth Portal Applicant Login.

- JanSamarthi Portal Grievance Redressel.

- Ministry of Education.

- Ministry of Social Justice and Empowerment.

- Ministry of Agriculture and Farmers' Welfare.

- Official Facebook Page.

- Official Instagram Page.

- Official Twitter Handle.

- FAQs.

Contact Details

- For Borrower :-

- Email :- Customer.support@jansamarth.in.

- Phone Number :- 079 69076111.

- For Bank and Others :-

- Email :- Bank.support@jansamarth.in.

- Phone :- 079 69076123.

Ministry

Do you have any question regarding schemes, submit it in scheme forum and get answers:

Feel free to click on the link and join the discussion!

This forum is a great place to:

- Ask questions: If you have any questions or need clarification on any aspect of the topic.

- Share your insights: Contribute your own knowledge and experiences.

- Connect with others: Engage with the community and learn from others.

I encourage you to actively participate in the forum and make the most of this valuable resource.

Stay Updated

×

Comments

not so enough schemes…

is there any scheme on this…

the portal said my aadhar…

what to do if you are not…

what to do if you are not eligible under any scheme

Batany zoology physics chemistry

I am pharmacy course in b parma

सलून

Naya

Nai thakur

Ha ma padh liya

Loan

Parsonal loan

వ్యాఖ్యానించండి