Highlights

- Normal Benefits :-

- Reimbursement of EPFO Contribution of Employer for 2 Years for additional employee hired.

- Maximum of Rs. 3,000/- per Month will be Reimbursed to Employer under this scheme.

- Extended Benefits :-

- Reimbursement will be done quarterly for previous quarter if Employer created more than 1,000 jobs.

- Reimbursement will also continue for 3rd and 4th year.

Website

Customer Care

- PM Employment Linked Incentive Scheme C: Support to Employers Helpline Nuumbers along with other contact details will be soon released by the Government.

Overview of the Scheme |

|

|---|---|

| Name of Scheme | PM Employment Linked Incentive Scheme C: Support to Employers. |

| Launched Year | 2024. |

| Scheme Period | 2 Years. |

| Benefits | Reimbursement of Employer EPFO Contribution for 2 Years. |

| Beneficiaries | Employer and First Time Employees of Manufacturing Sector. |

| Nodal Department | Not known yet. |

| Subscribe | Subscribe here to get Update Regarding Scheme |

| Mode Of Apply | Through Employment Linked Incentive Scheme C: Support to Employers Application Form. |

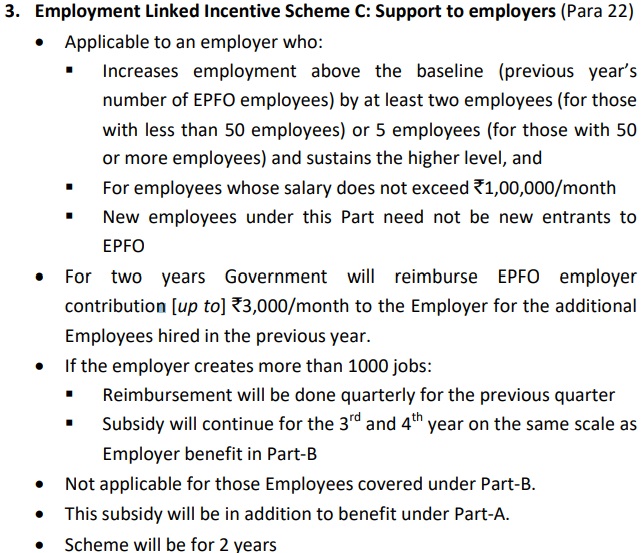

Introduction

- Finance Minister Nirmala Sitharaman presents the Union Budget in Parliament on 23rd of July 2024.

- To fight employment and to generate jobs, she announced Prime Minister's Package for Employment and Skilling.

- Prime Minister's Package for Employment and Skilling consists 5 Sub schemes.

- One of the schemes to benefit job provider is "Employment Linked Subsidy Scheme C: Support to Employers.

- The main objective of this scheme is to encourage employers of country to generate more and more job opportunities for the youth of country.

- Government of India will now reimburse the EPFO Contribution of a Employer under Scheme C: Support to Employers.

- Rs. 3,000/- per month EPFO contribution will be reimbursed to Employer under this scheme.

- Benefits of Reimbursement of EPFO contribution will only applicable for those Employers who increase the employment in their establishment above baseline.

- Here baseline means, Hire the EPFO Employees more than the number of previous year.

- Employers has to hire minimum 2 employees in case of less than 50 employees.

- However if establishment has more than 50 employees then employer has to hire minimum 5 employees in order get the benefit of Employment Linked Subsidy Scheme C: Support to Employer.

- If Employer generates more than 1,000 jobs then he will get additional benefits under this scheme.

- This scheme is only operational for 2 years subject to extend with proper approval from Government.

- It is to be expected that more than 50 lakh persons will get the benefit of Scheme C of Employment Linked Incentive which is mainly to support employers.

- Budget of Rs. 32,000/- crore will be sanctioned for the better implementation of this scheme.

- Application Form, Application Process and Remaining Eligibility Criteria of Employment Linked Incentive Scheme C: Support to Employer will be released soon with its guidelines.

- We will update it here as soon as we get any information about this scheme.

Benefits of the Scheme

- Employer will receive the following benefits under Indian Government's Employment Linked Incentive Scheme C: Support to Employers :-

- Normal Benefits :-

- Reimbursement of EPFO Contribution of Employer for 2 Years for additional employee hired.

- Maximum of Rs. 3,000/- per Month will be Reimbursed to Employer under this scheme.

- Extended Benefits :-

- Reimbursement will be done quarterly for previous quarter if Employer created more than 1,000 jobs.

- Reimbursement will also continue for 3rd and 4th year.

- Normal Benefits :-

Eligibility Criteria

- Reimbursement of EPFO contribution to Employer under Employment Linked Incentive Scheme C: Support to Employers will only granted if Employer fulfil the following eligibility criteria :-

- Employers of all Sector are Eligible.

- Employer should increase the Employment every year above baseline. (More Employee than Previous Year's Number of EPFO Employee)

- The number of Employee increased by the Employer every year should be :-

- 2. (If Employer has Less than 50 Employees)

- 5. (If Employer has more than 50 Employees)

- Salary of Employer's Employee should not be more than Rs. 1,00,000/- per month.

- Employer can also recruit Non First Timers (Already Registered in EPFO) Employee.

Documents Required

- Documents that might be needed at the time of availing the benefit of PM's Employment Linked Incentive Scheme C: Support to Employers are as follows :-

- Registration Details of Employer.

- Employer Photograph.

- EPFO Registration Details of Employer.

- Complete Buora of Hired Employee.

- Employer Bank Account Details.

How to Apply

- Finance Minister Smt. Nirmala Sitharaman presents Union Budget on 23rd of July 2024 and announced Employment Linked Incentive Scheme C for Support to Employers.

- This is just an announcement yet and concerned department of Government of India will soon draft the Guidelines of Employment Linked Incentive Scheme C: Support to Employers.

- Cabinet will approve it then and give its nod to launch this scheme in whole country to provide support to employers.

- PM Employment Linked Incentive Scheme C: Support to Employers application procedure is not available right now.

- Employment Linked Incentive Scheme C: Support to Employers application process will be clear after the release of its guidelines.

- Mode of Application is decided by Government of India whether to accept applications through Offline Application Form or through Online Application Form.

- Employment Linked Incentive Scheme C: Support to Employers Website might also be launch for employer to apply and claim the reimbursement.

- As soon as we get any update about the application process of Employment Linked Incentive Scheme C for Support to Employers, we will update the same.

Important Links

- PM Employment Linked Incentive Scheme C: Support to Employers Application Form and its guidelines will be released by the concerned department very soon.

Contact Details

- PM Employment Linked Incentive Scheme C: Support to Employers Helpline Numbers along with other contact details will be soon released by the Government.

Do you have any question regarding schemes, submit it in scheme forum and get answers:

Feel free to click on the link and join the discussion!

This forum is a great place to:

- Ask questions: If you have any questions or need clarification on any aspect of the topic.

- Share your insights: Contribute your own knowledge and experiences.

- Connect with others: Engage with the community and learn from others.

I encourage you to actively participate in the forum and make the most of this valuable resource.

| Person Type | Scheme Type | Govt |

|---|---|---|

Stay Updated

×

Add new comment