.

.

Introduction:-

Divyangjan Swalamban Scheme was launched to provide concessional credit for the benefit of the persons with disabilities. To start any activity that contributes directly or indirectly in the income generation or helping PwD in their overall process of empowerment. Pursuing higher education after class 12th (UG, PG, Professional courses and other courses approved by UGC/AICTE/ICAR/Government etc). To pursue vocational or skill development (ITI, Diploma any other course leading to enhancement of employment or self employment). Purchase and/or fitment of any assistive device(s)/customization/retrofitting or conversion of available machine, equipment, vehicle to disabled friendly mode.

Objective : -

The main objective of the Divyangjan Swalamban Scheme is to assist the needy disabled persons by providing concessional loan for economic and overall empowerment.

A Unique Disability ID is provide to the person with disability. It is implemented with a view of creating a National Database for PWDs.

Benefits : -

- Persons with disabilities need not to have multiple copies of documents as this card will be sufficient to capture all necessary details.

- Stream-lining the tracking of the physical and financial progress of the applicants at all levels of implemented hierarchy from village level, block level, District level, State level and National level will become easy with the help of UDID card.

- The UDID card will be the single document of identification, verification of the disabled for availing various benefits in future.

Eligibility Criteria : -

- The person should be above 18 years in age . However, in case of persons with mental retardation, the eligible age would be above 14 years. The age criteria would not be required for educational loans.

- Any Indian citizen with 40% or more disability (Disability as defined in PwD Act, 2016 or its amendments). There are several categories under this such as ; -

- Blindness : Total absence of sight, Visual acuity not exceeding 6/60 or 20/200 (Snellen) in the better eye with correcting lenses , Limitation of the field of vision subtending an angle of 20 degree or worse.

- Cerebral Palsy : abnormal motor control posture resulting from brain insult or injuries occurring in the pre-natal, peri-natal or infant period of development.

- Locomotor disability : It means disability of the bones, muscles or joints which leads to substantial restriction of the movement of the limbs or nay form of cerebral palsy.

- Mental retardation : It refers to a condition of arrested or incomplete development of mind of a person which is specially characterized by sub normality of intelligence.

- Mental illness : It means any mental disorder other than mental retardation.

- Impairment of hearing : It means loss of 60 decibels or more in the better ear in the conversational range of frequencies.

- Leprosy-cured : (a) The person suffering from manifest deformity and paresis , (b) Loss of sensation in hands or feet as well as loss of sensation and paresis in the eye and eye-lid (c) Extreme physical deformity as well as advanced age which prevents him from undertaking gainful occupation.

Amount of Loan: -

The upper limit to extend concessional credit through various (National Handicapped Finance and Development Corporation) NHFDC schemes would be Rs.50,00,000 per applicant/unit. The actual loan amount within the upper limit of Rs.50 lakhs will be determined by implementing agencies based on the needs of the activity/project being funded as well as repaying capacity of the borrower within the maximum repayment period.

|

Rate of Interest on loan amount :-

|

||||

|---|---|---|---|---|

| S.No | Loan amount(Rs.) | Rate of Interest(%) | Implementing Agency margin(%) | Rate of Interest to PWDs(%) |

| (1) | (2) | (3) | (4) | (5) (3+4) |

| (i) | Less than Rs. 50 thousand | 2 | 3 | 5 |

| (ii) | Rs. 50 thousand to Rs. 5 Lakh | 3 | 3 | 6 |

| (iii) | From Rs. 5 Lakh to Rs. 15 lakh | 3 | 4 | 7 |

| (iii) | From Rs. 15 Lakh to Rs. 30 Lakh | 4 | 4 | 8 |

| (iv) | Rs. 30 Lakh to Rs. 50 Lakh | 4.5 | 4.5 | 9 |

| Note : Rebate of 1% in interest will be allowed to women with disabilities/persons with disabilities other than OH in self employment loans of upto Rs.50,000/- . The rebate will be borne by NHFDC. | ||||

Type of Loan :-

The nature of the loan could be

- term loan

- working capital loan

Repayment of Loan : SCAs would be at liberty to decide activity wise/ case-wise repayment schedule within overall limit of 10 years from the date of disbursement of loan.

Security :-

- Implementing Agencies should strive to seek requisite security as per their respective policies and may also try to cover any portion of the loan not covered with ample security/collateral security through Central Government Guarantee schemes.

- The implementing agencies should ensure adequate insurance coverage of the assets and beneficiaries.

How to apply for loan :-

Application in the prescribed format is to be submitted to the implementing agency for sanction of loan as per procedure & general terms & conditions as laid down, from time to time, by National Handicapped Finance and Development Corporation.

Four types of details are required:-

- Personal Details with Address

- Details of Disability

- Details of Employment

- Details of Identity

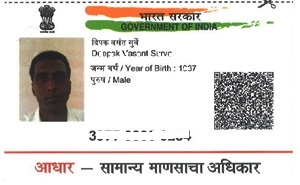

Documents needed to apply for UDID Card :-

- Scanned copy of recent color photo.

- Scanned copy of Address Proof

- Aadhar Card

- Driving License

- State Domicile etc

- Scanned copy of Identity proof

- Aadhar Card

- PAN Card

- Driving License

- Aadhar Card

- Scanned copy of Disability Certificate (issued by competent Authority)

Note: At this stage only PwD registration has been started. Generation of UDID (Unique Disability ID) has not yet started and will be informed through this portal when it comes in effect.

Online procedure to apply for Unique Disability ID : -

Step 1Applicant will click on register link to register with UDID Web Portal.

Step 2Using credentials PwD logs in to system and click "Apply online for Disability Certificate. Reads instructions and fills up online application.

Step 3

Upload color passport photo and other requisite documents like

- Income Proof,

- Identity Proof

- SC/ST/OBC proof as required.

Step 4Submits data to CMO Office/Medical Authority.

Step 5CMO Office/Medical Authority verifies data.

Step 6CMO Office/Medical Authority assigns the concerned specialist(s) for assessment.

Step 7Specialist Doctor assesses disability of PwD and gives opinion on disability.

Step 8Medical Board reviews the case and assign disability percentage. CMO Office prepares Disability Certificate and generates UDID and Disability Certificate.

Step 9UDID datasheet goes for UDID Card printing and Card dispatched to PwD.

Contact details :-

Address : -

Shri Vikash Prasad

Director

Department of Empowerment of Persons with Disabilities,

Ministry of Social Justice & Empowerment

Room No. 5, B-I Block, Antyodaya Bhawan,

CGO Complex, Lodhi Road,

New Delhi - 110003 (India)

vikash.prasad@nic.in

Contact form for UDID Card - Contact form

UDID Login - login

UDID Online Registraion - Online application

Do you have any question regarding schemes, submit it in scheme forum and get answers:

Feel free to click on the link and join the discussion!

This forum is a great place to:

- Ask questions: If you have any questions or need clarification on any aspect of the topic.

- Share your insights: Contribute your own knowledge and experiences.

- Connect with others: Engage with the community and learn from others.

I encourage you to actively participate in the forum and make the most of this valuable resource.

| Caste | योजना प्रकार | Govt |

|---|---|---|

Comments

Milega kya kya isme

sir me 60 percent divynag hu…

loan lene ke smbandh mai

Businesses

Plz help me muje 20 lakh la loan chaiye

UDID

SIR,I ALREADY HAVE A DISABILITY CERTIFICATE ISSUED BY GOVT OF TAMILNADU,BUT I DO NOT HAVE A UDID.,MY QUESTIONS ARE;

1.DO I STILL NEED A UDID TO APPLY FOR AN EDUCATIONAL LOAN? OR IS A DISABILITY CERTIFICAE SUFFICIENT ?

2.WHAT IS THE PROCEDURE TO APPLY FOR UDID ?

Lone

Dukan kirana storse

Lone

Biasness

Education

My education ke liye

60% Hun lone ke kye kya kru

Batao sir

Business loan

Sir 40%divyang hi Business…

Sir 40%divyang hi Business karne ke liye pareshan hu mujhe kuch loan mil jay to mai apna business badha sakta hu kisi ka muhtaj nahi rahunga pls help

Handicap 50%

Dakan ka loan

Loan divvyang

Se munjha 1000000 loan chahiye kaisa mailaga

surety

Need of any types of surety for loan

For Education

Sir hame 5 lack rupye lone dede ka kast kare education ke liye please help contact

Loan for four wheeler व्हीकल

मुझे फोर व्हीलर के लिए लोन चाहिए अधिक जानकारी कैसे प्राप्त कर सकता हूं और अप्लाई करने का क्या तरीका होगा मैं 75% फिजिकली हैंडिकैप्ड वर्तमान में सरकारी कर्मचारी भी हूं

Vaparam

Ella ramesh 4_10 dharmraupeta ganapur moolugu

Vaparam

Ella ramesh 4_10 baswaraj pally 4_10 dharmraupeta ganapur moolugu

नवी प्रतिक्रिया द्या