The Government of India launched the Startup India Scheme on August 15, 2015, with the vision to create a robust startup ecosystem in the country. It provides numerous benefits to eligible startups such as tax exemptions, simplified compliance, funding opportunities, and fast-tracked patent processes.

To access these benefits, startups must be officially recognized by the Department for Promotion of Industry and Internal Trade (DPIIT) through a dedicated and transparent registration process.

What is DPIIT Recognition?

- DPIIT Recognized Certificate is the official recognition of a startup business by the Government of India under the Startup India Scheme.

- It is issued by the Department of Promotion of Industry and Internal Trade, which signifies that the recognized Startup is genuine and totally based on innovation and has the potential to generate wealth and employment.

- After recognition from DPIIT, the Startups are open to avail the benefits of tax exemption, subject to eligibility, the single window for government compliances, and funding opportunities.

- Any Private Limited Company or Limited Liability Partnership or Partnership Firm can register their startup business to be recognized it by DPIIT.

- Startups that are more than 10 years old from the date of their incorporation are not eligible to apply for DPIIT recognition.

- Anyone can register their startup on their own and there is no need of middlemen and the whole application process is completely free of cost.

- Visit the National Single Window System Portal, apply for DPIIT recognition for Startups and avail the benefit of tax exemption, easy compliances, IPR fast tracking and many more government services.

- Till date, more than 176192 startups get recognized by DPIIT.

Benefits Provided to DPIIT-Recognized Startups

- Self Certification.

- Startup Patent Application and IPR Application.

- 3 Years Tax Exemption under 80IAC.

- Section 56 Exemption.

- Winding Up of Company is Easy.

- Easy Public Procurement Norms.

Benefits Provided in Detail

| Benefit Type | Benefit Details |

|---|---|

| Self Certification |

|

| Startup Patent and IPR Application |

|

| Tax Exemption under 80 IAC |

|

| Exepmtion under Section 56 |

|

| Easy Winding Up of Company |

|

| Easier Public Procurement Norms |

|

Eligibility Requirements for Startups

- Company should be a Private Limited Company or Limited Liability Partnership or Partnership Firm.

- The Age of Company should not be more than 10 years from its incorporation.

- The Annual Turnover of a Company should not be more than Rs. 100/- crore.

- Company should be working for development, product improvement, process or service and have high potential to create wealth and employment.

- Company should not be formed by splitting up or reconstructing an old business.

Required Documents

- Copy of Certificate of Incorporation or Registration.

- A Small Write Up about Company's nature of Business.

- Company Logo.

- Memorandum of Association.

- Certificate of Incorporation.

- Mobile Number, Email ID and Address of Director.

- GST Certificate.

- Digital Signature Certificate. (DSC)

Steps to Apply for DPIIT Recognition for Startups

- Any Eligible Startup can apply for DPIIT recognition certificate online.

- Central Government make whole certification process online for companies.

- There is a National Single Window System Portal through which a startup company can apply for DPIIT recognition certificate.

- Visit https://www.nsws.gov.in.

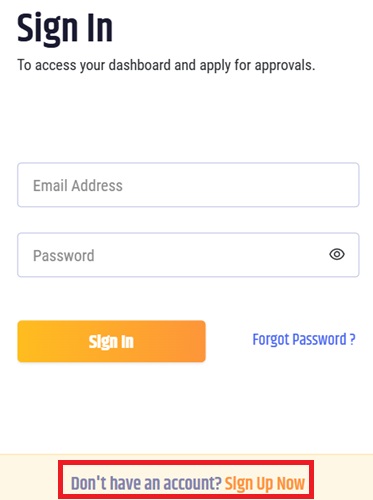

- Click on Login and Choose Business User Login.

- Then you have click on Sign Up Now.

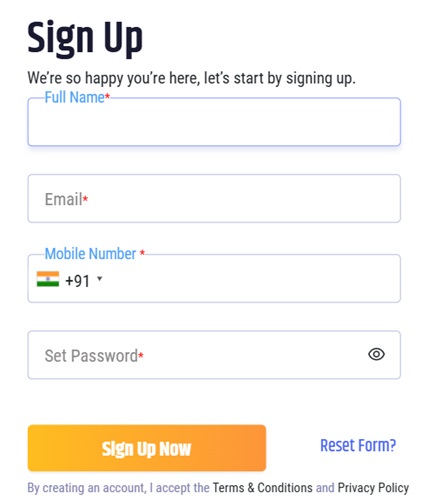

- Fill Name, Email ID, Mobile Number and set a password of you choice.

- Portal will verify the Email ID and Mobile Number through OTP.

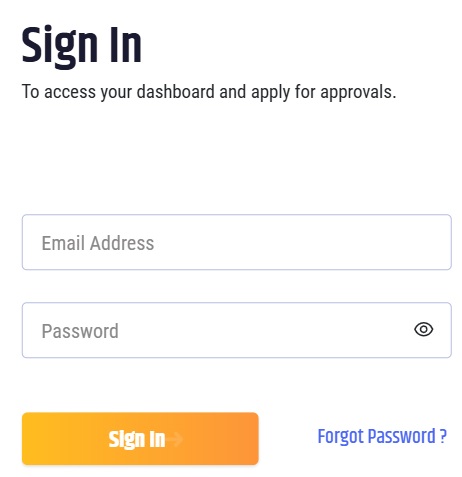

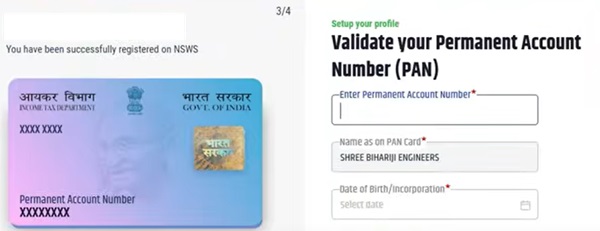

- Login with Email ID and Password on National Single Window System Portal.

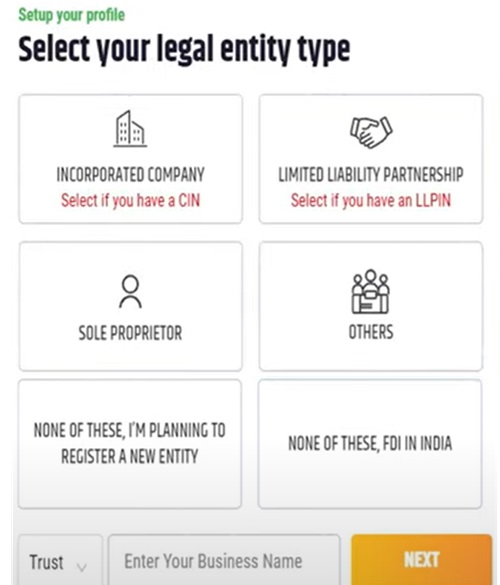

- Select Your Entity Type.

- You have to then Register your Company by entering the following details :-

- Type of a Company (LLP/ Pvt Ltd. etc)

- PAN Card of Company.

- Postal and Registered Address of a Company.

- Company will have to Validate their PAN Card also.

- Fill the details of authorized signatory of a company.

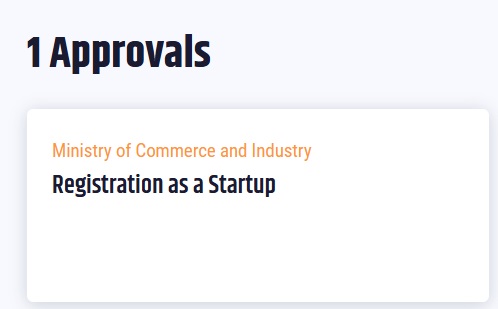

- Click on Central Approvals and search for Registration as a Startup after registering a company.

- An Common Registration Form will appear in front of your screen after clicking on Apply Now.

- You have to fill the below mentioned details in the form to Register your company as Startup and have it recognized by DPIIT :-

- Startup Profile.

- Entity Details.

- Full Address of a Company.

- Authorized Representative Details.

- Director/ Partner Details.

- Employee Details in a Company.

- Nature of Startup.

- Any Earlier Funding Received.

- Activities of Startup.

- Upload Certificate of Incorporation and Authorization after filling all the details.

- Check the filled details and Click on Submit Button.

- Concerned officials of DPIIT will verify the received information and approved the application.

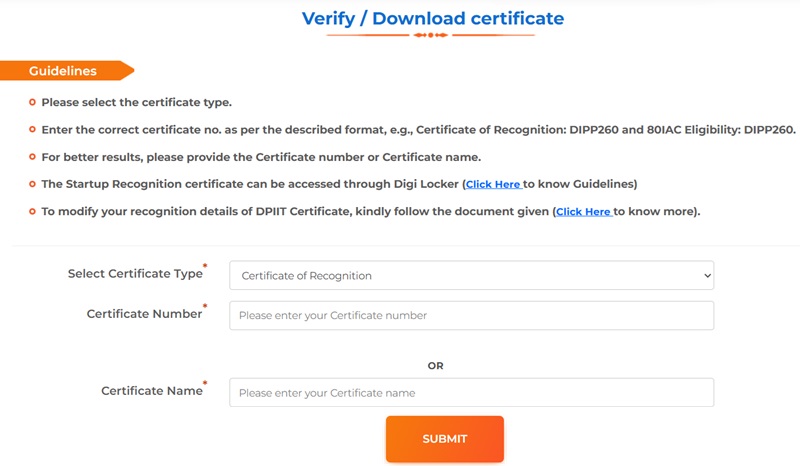

- Download your Startup's DPIIT Recognition Certificate from Startup India Official Website by entering Certificate Number or Name of the Company.

Sample DPIIT Certificate of Recognition for Startups

Relevant Links

- Startup India Official Website.

- National Single Window System Website.

- Guidelines Follow for DPIIT Recognition for Startup.

- Download/ Verify DPIIT Recognised Certificate.

- Department for Promotion of Industry and Internal Trade.(DPIIT)

- Startup DPIIT Recognition Registration Guide.

Contact Information

- Startup India Toll Free Number :- 1800115565.

- National Single Window System Toll Free Number :- 18001025841.

- National Single Window System Email :- contactus-nsws@investindia.org.in.

Frequently Asked Questions

Yes, DPIIT recognition is essential to access key benefits under the Startup India Scheme like tax exemption under section 80 IAC, IPR support, and government tenders with relaxed criteria.

Absolutely. The entire DPIIT recognition process is self-service and completely free. No consultant, CA, or agent is required to apply. Any founder or authorized person can apply directly through the National Single Window System.

No, tax exemption under 80 IAC is a separate application after receiving DPIIT recognition. The startup must apply for the exemption and meet the eligibility criteria like incorporation date and business model validation.

No, DPIIT does not specify a limit on the number of directors or partners. However, the company must be registered as a Private Limited Company, LLP, or Partnership Firm.

Once submitted, the DPIIT team reviews the application manually. If everything is in order, recognition is usually granted within 7–10 working days. A downloadable certificate is then available online.

Add new comment