Highlights

- Short Term Working Capital Loan up to :-

- Rs. 10,000/-.

- Rs. 20,000/-.

- Rs. 50,000/-.

- No Collateral Required.

- Interest Subsidy of @ 7% on Timely or Early Repayment.

- UPI Linked Credit Card will be issued by the bank with a limit of Rs 30,000/-

- Monthly Cashback of Rs. 50/- to Rs. 100/- on Digital Transactions.

Customer Care

- PM SVANidhi Scheme Helpline Number :- 1800111979.

- PM SVANidhi Scheme Grievance Helpline Number :- 011 23062850.

- PM SVANidhi Scheme State Wise Helpline Number.

- PM SVANidhi Scheme Helpdesk Email :-

- portal.pmsvanidhi@sidbi.in.

- pmsvanidhi.support@sidbi.in.

Information Brochure

|

Summary of the Scheme

|

|

|---|---|

| Name of Scheme | PM SVANidhi Scheme. |

| Launch Year | 2020. |

| Benefits |

|

| Beneficiary | Street Vendors. |

| Official Portal | PM SVANidhi Scheme Portal. |

| Nodal Ministry | Ministry of Housing and Urban Affairs. |

| Subscription | Subscribe here to get Update Regarding Scheme |

| Mode of Apply | Online through PM SVANidhi Portal. |

Scheme Introduction: A Brief Overview

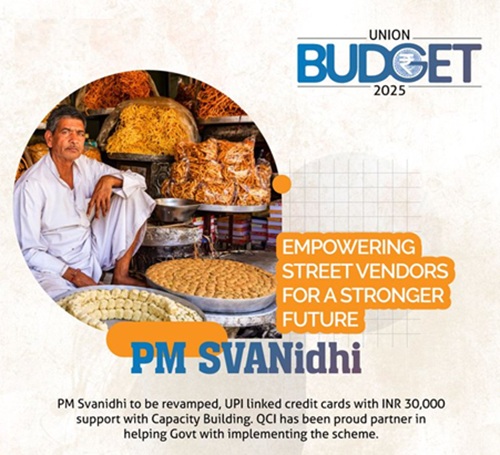

- In order to support the street vendors, the central government has introduced a scheme called "PM SVANidhi Scheme".

- Launched in the year 2020, the primary aim of the scheme is to support these vendors financially by offering them short term loans up to Rs 50,000/-.

- PM SVANidhi Scheme stands for PM Street Vendor's AtmaNirbhar Nidhi.

- The Ministry of Housing and Urban Affairs of the central government is the nodal agency of the scheme.

- The scheme was launched to provide necessary financial support to these small vendors whose businesses were affected or closed during the lockdown.

- Through this scheme, the government will empower street vendors across the Nation.

- It is a special micro credit facility for the welfare of Street Vendors.

- Schemes like Pradhan Mantri Mudra Yojana and PM Vishwakarma Yojana, which offer loan for small business.

- Under PM SVANidhi Scheme, Government of India will provide short term loans to the Street Vendors.

- Loan will be provided as a working capital loan so that they can invest the amount in their businesses.

- Initially a loan of Rs. 10,000/- will be given to the street vendors for a period of 1 year.

- If the street vendor returns the loan amount within one year, then their loan limit will be increased subsequently to Rs. 20,000 first and Rs. 50,000/.

- However, in the budget of 2025-26, the central government has introduced UPI Linked credit card with a limit of Rs 30,000/-.

- Around 68 lakh street vendors has been benefited from the scheme yet.

- The loan provided under the PM SVANidhi Scheme will be offered at an interest subsidy of 7%.

- To promote digital transaction among the vendors, a monthly cashback up to Rs 100/- will be provided to these vendors.

- PM SVANidhi Scheme loan is collateral free, which means beneficiaries are not required to submit security for it.

- Beneficiaries who are eligible for the PM SVANidhi Scheme can submit their application online from PM SVANidhi Scheme Portal.

Scheme Benefits

- Short Term Working Capital Loan up to :-

- Rs. 10,000/-.

- Rs. 20,000/-.

- Rs. 50,000/-.

- No Collateral Required.

- Interest Subsidy of @ 7% on Timely or Early Repayment.

- UPI Linked Credit Card will be issued by the bank with a limit of Rs 30,000/-

- Monthly Cashback on Digital Transactions.

Eligibility Requirements

- Applicant must be a Street Vendor in urban areas.

- Applicants must be in a possession of following certificate : -

- Certificate of Vending/ Identity Card issued by Urban Local Bodies (ULBs).

- Letter of Recommendation from Town Vending Committee.

- Vendors identified in the survey list but have not been issued Vending Certificate or Identity Card.

- Street Vendor who have been issued Letter of Recommendation (LOR) by the ULB or Town Vending Committee (TVC).

Required Documents

- Survey Reference Number.

- Any One of the Street Vending Proof :-

- Vendor Identity Card.

- Certificate of Vending.

- Letter of Recommendation from TVC.

- Aadhar Card.

- Aadhar Linked Mobile Number.

- Any one of the document for KYC :-

- Aadhar Card.

- Voter Identity Card.

- Driving License.

- MNREGA Card.

- PAN Card.

Steps to Apply

- Applicant has to visit PM SVANidhi Portal to apply Online.

- Login by providing your mobile number.

- Portal will verify the mobile number by sending OTP.

- After Login, Choose one of the eligibility category :-

- Vendor Identity Card.

- Certificate of Vending.

- Letter of Recommendation from TVC.

- Fill the Application Form of PM SVANidhi Scheme and Upload all the KYC Documents.

- Submit the Application Form.

- Now the lending financial institutions will contact the applicant.

- After verification of documents, the loan amount will be credited to the bank account of Street Vendor.

Key Features of the Scheme

- The vendor will be eligible for the second loan cycle only after the first loan is repaid.

- Interest subsidy will be directly credited into the borrower account.

- Monthly Cashback will be received by the vendor ranging from Rs. 50/- to Rs. 100/- as per following criteria :-

Transactions

(Per Month)Monthly Cashback 50 Rs. 50/- 100 Rs. 75/- 200 Rs. 100/- - Loan will be approved within 30 days of application.

- Vendor can avail the benefit of PM SVANidhi Scheme from the following lending institutions :-

- Schedule Commercial Banks.

- Regional Rural Banks.

- Small Finance Banks.

- Cooperative Banks.

- Non Banking Financial Companies.

- Micro Finance Institutions.

- Self Help Group Banks.

- Mobile Number linked with Aadhar Card and Aadhar Card is mandatory to apply.

Street Vendors Eligible Under PM SVANidhi Scheme

- The below mentioned Street Vendors are eligible to get short term loan under Pradhanmantri SVANidhi Scheme :-

- Hawkers.

- Rehriwala.

- Thelewala.

- Services like Barber Shops.

- Theli Phadwala.

- Pan Shops.

- Cobblers.

- Laundry Services.

- Vegetable Sellers.

- Person Working in Temporary Built up Structure etc.

Relevant Links

- PM SVANidhi Scheme Online Apply.

- PM SVANidhi Scheme Application Status.

- PM SVANidhi Scheme Mobile Number Change.

- PM SVANidhi Scheme Vendor Survey List.

- PM SVANidhi Scheme Portal.

- PM SVANidhi Scheme Guidelines.

- PM SVANidhi Scheme FAQs.

- PM SVANidhi Scheme Mobile App.

Contact Information

- PM SVANidhi Scheme Helpline Number :- 1800111979.

- PM SVANidhi Scheme Grievance Helpline Number :- 011 23062850.

- PM SVANidhi Scheme State Wise Helpline Number.

- PM SVANidhi Scheme Helpdesk Email :-

- portal.pmsvanidhi@sidbi.in.

- pmsvanidhi.support@sidbi.in.

- Ministry of Housing and Urban Affairs, Government of India,

Nirman Bhawan, Maulana Azad Road,

New Delhi - 110011.

Do you have any question regarding schemes, submit it in scheme forum and get answers:

Feel free to click on the link and join the discussion!

This forum is a great place to:

- Ask questions: If you have any questions or need clarification on any aspect of the topic.

- Share your insights: Contribute your own knowledge and experiences.

- Connect with others: Engage with the community and learn from others.

I encourage you to actively participate in the forum and make the most of this valuable resource.

Stay Updated

×

Comments

sirf rehdi walo ke liye hai,…

sirf rehdi walo ke liye hai, pheri wala apply kr sakta hai jo paidal ghoom ghoom ke saaman bechta hai

10000

Ka loan disbursed ho chuka hai mila nhi h Bank walo ne chakkar katva rakhe hai

Other

Othar

Bimari

Arjent h

Craft

Help government my in proved buisness

Yadav

Extend my Indian

Maths

I am a siva

Problem sir

Hello sir please

Pm savanadhi

Sair mara bank portal ma change karna ha

Private job

Loan

Muje lone ki zarurat hai

Muje lone kese milega

50,000

Mujhe lone chahiye argent jarurat he

50,000

Mujhe lone chahiye argent jarurat he

Walding wark

Me welding ka kaam karta ho

Ghar lon

Thanks

pm svanidhi loan apply online

pm svanidhi loan apply online

Ramkrishna

Kam

Ramkrishna

Kam

Guwahati

It's ok to diasu the day ahead of you and family are very good looking for a Gaya

ITI

20000

Help me please

LPU emergency please me

Loan pass nahi hua

Sirf application submit karwaye hai baki paise nahi aaye account me na hi ka cal aaya Mai Satna mp se hu

Sab kahani hai jhuthi

Hin

Loan ki avashyakta hai padhaai karne ke liye

Add new comment