Highlights

- Contributory Pension Scheme for Minors.

- Minimum Contribution of Rs. 1,000/- per Year.

- Pre Mature Fund With drawl Facility.

Customer Care

- NPS Subscriber Helpline Number :- 18002100080.

- PFRDA Toll Free Number :- 1800110708.

- PFRDA Contact Numbers.

Information Brochure

|

Summary of the Scheme

|

|

|---|---|

| Name of Scheme | NPS Vatsalya Scheme. |

| Launched Year | 18-09-2024 |

| Benefits | Contributed Pension for Minors. |

| Beneficiaries | Below 18 Years of Age Children. |

| Subscription | Subscribe Here to Get Updates Regarding Scheme. |

| Mode of Apply | Both Online and Offline Mode Available. |

Scheme Introduction: A Brief Overview

- Finance Minister Nirmala Sitharaman announced NPS Vatsalya Scheme at the time of her budget speech.

- NPS Vatsalya Scheme is launched on 18th of September 2024.

- NPS Vatsalya Scheme refers to National Payment Sytem Vatsalya Scheme.

- Here Vatsalya word specifies that this scheme is for minor children.

- Pension Fund Regulatory Development Authority is the regulatory agency of this scheme.

- The main objective behind starting NPS Vatsalya Scheme is to encourage minors/ childrens to save for their retirement.

- Currently Central Government is operating National Pension System Scheme for its citizens who are above 18 years of age.

- But NPS Vatsalya Scheme is specifically designed for childrens of below 18 years of age.

- This Scheme is a contributory saving cum pension scheme for minors which offers them to save for their retirement.

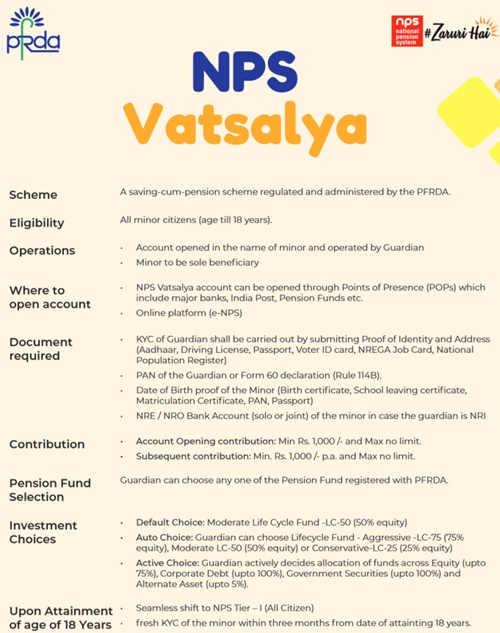

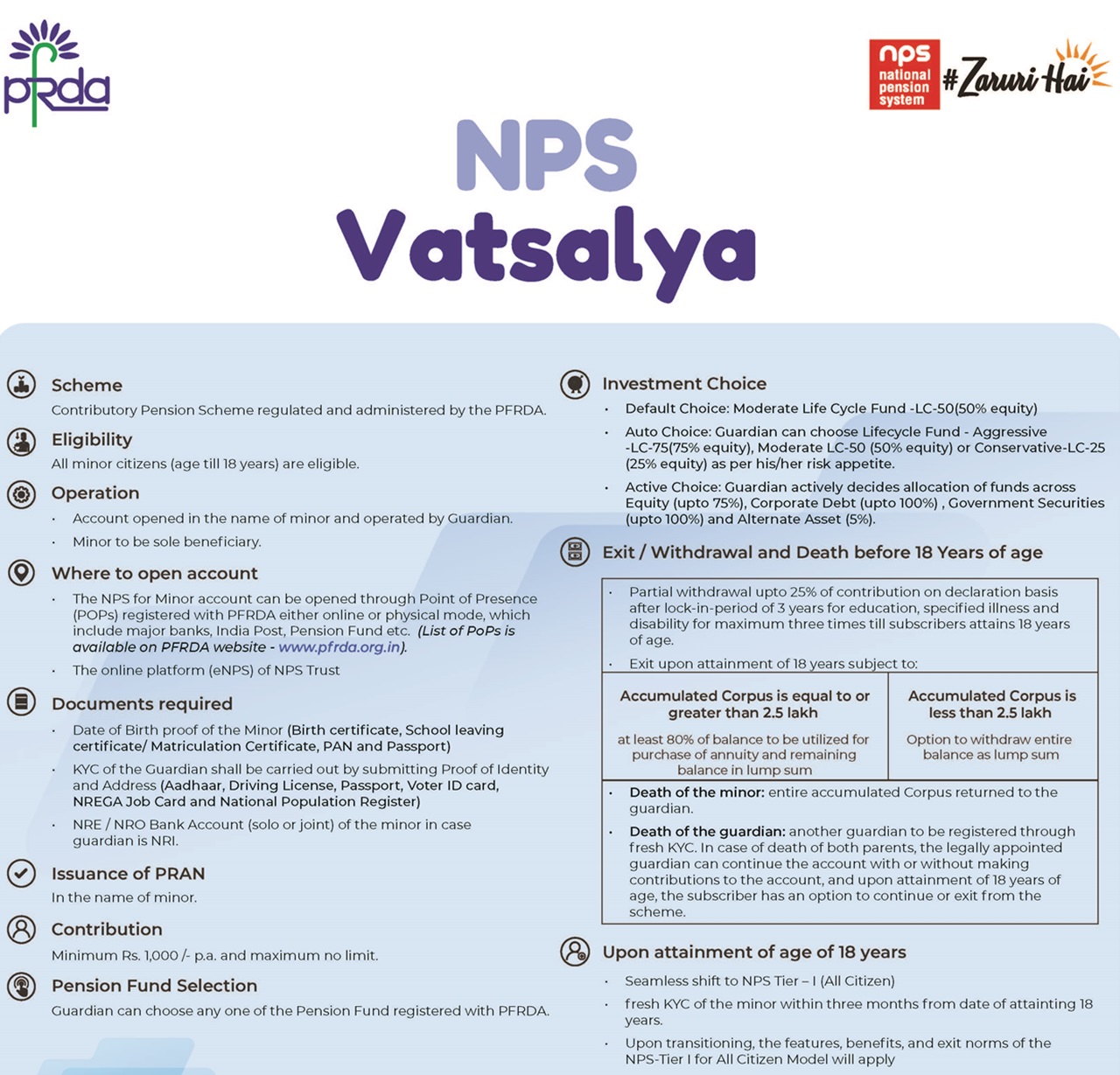

- All minor citizen of India whose age is below 18 years are eligible to avail the benefit of NPS Vatsalya Scheme.

- Apart from that Non Resident Indians (NRIs) and Overseas Citizen of India (OCI) can also open their minor children account under NPS Vatsalya Scheme.

- Account opened under this scheme will be operated by the Guardians of Minor till they attain the age of 18 years.

- A minimum and mandatory contribution of Rs. 1,000/- per year will be deposited in the NPS Vatsalya Pension Account.

- There will be no maximum limit of contribution under this scheme.

- Central Government has also provided the facility to withdraw deposited fund after completing the minimum lockin period of 3 years.

- Further details of withdrawl and exit under NPS Vatsalya Scheme is mentioned below.

- Guardians of the minors can open NPS Vatsalya Scheme through Online and Offline Mode.

- Online Application Form of NPS Vatsalya Scheme is available Here.

- Also Offline Application Form of National Pension System Vatsalya Scheme can be collected from any major banks and post office branch.

Withdrawl and Exit in NPS Vatsalya Scheme

Exit or Withdrawl Before 18 Years of Age |

|---|

|

Exit or Withdrawl After Attaining the Age of 18 Years |

|

Exit or Withdrawl In Case of Death of Minor |

|

Exit or Withdrawl In Case of Death of Guardian |

|

Scheme Benefits

- Minor beneficiaries will receive the following benefits under Central Government's NPS Vatsalya Scheme :-

- Beneficiary Can Contribute Minimum Rs. 1,000/- per year in Pension Account for Future Use.

- There will be no maximum deposit limit.

- After minimum lockin period for 3 years, beneficiary can withdraw 25% of amount in special case.

- 3 Withdrawls will be permitted before beneficiary attain the age of 18 years.

- NPS Vatsalya will automatically converted to normal NPS after beneficiary attains 18 years of age.

Eligibility Requirement

- Government of India sets the following eligibility conditions of NPS Vatsalya Scheme which is going to be fulfilled by the beneficiaries :-

- Only Minors (below 18 years of age) are Eligible to Apply.

- Guardians of Minor will operate the NPS Vatsalya Account.

- NRI and OCI are also eligible to open account.

Required Documents

- Guardians of the Minor Beneficiary will have required the below mentioned documents in order to open account under NPS Vatsalya Scheme :-

- Minor Date of Birth Proof.

- Signature of the Guardian.

- PAN Card of Guardian.

- Passport Scanned Copy. (For NRI Applicant)

- Foreign Address Proof Copy. (For OCI Applicant)

- Bank Passbook Copy. (For NRI and OCI Applicant)

Steps to Apply

- Minor Beneficiary Guardins can open account under NPS Vatsalya Scheme through 2 ways :-

- Through NPS Vatsalya Scheme Online Application Form.

- Through NPS Vatsalya Scheme Offline Application Form.

Online Application Process

- Online Application Form of NPS Vatsalya Scheme is available on Protean e-Gov Technologies Limited Website which is jointly work with NSDL.

- Select NPS Vatsalya Minor and Click on Register Now.

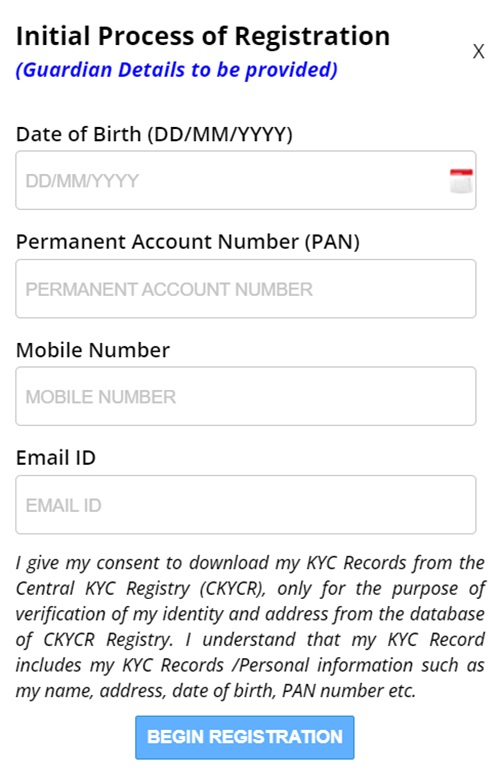

- Guardians of the Minor will have to fill below mentioned details in the initial registration form :-

- Website will verify the Mobile Number and Email ID through OTP verification.

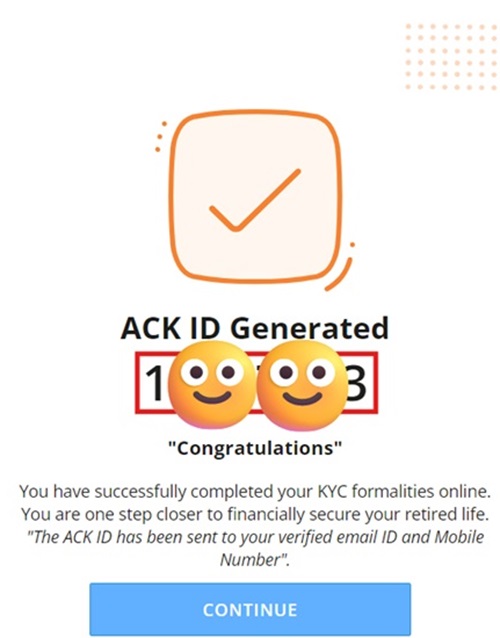

- After successfull verification, an acknowledgement id will be generated.

- NPS Vatsalya Scheme Registration Form will opened after clicking on continue button.

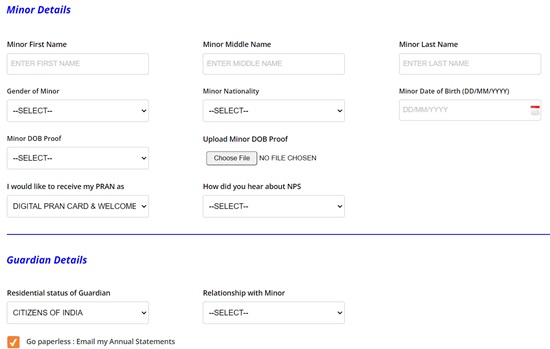

- Fill Minor Details and Guardian Details.

- Upload Signature and Date of Birth Proof of Minor.

- Preview the filled details and click on submit button to submit it.

- Website will generate PRAN (Permanent Retirement Accoint Number) in the name of Minor Beneficiary.

- Complete details and welcome kit of NPS Vatsalya Scheme will be sent to beneficiary on their given postal address.

- Guardians of the beneficiary then contribute minimum deposit of Rs. 1,000/- in the NPS Vatsalya Scheme Account.

Offline Application Process

- Beneficiaries can also open their pension accounts under NPS Vatsalya Scheme through by filling Offline Application Form.

- Offline Application Form of NPS Vatsalya Scheme is available free of cost at any bank and post office.

- Collect the NPS Vatsalya Scheme Application Form and fill it correctly.

- Attach all the required documents with the application form.

- Now submit the Application Form along with all the documents in the same bank or post office branch.

- Bank or Post Office Officials will verify the received application form and verify the details.

- After successuful verification, bank or post office officials will open the NPS Vatsalya Scheme pension account in the name of minor beneficiary which is operated by Guardian.

- Guardian can deposit minimum Rs. 1,000/- annually without having maximum limit in that account.

Relevant Links

- NPS Vatsalya Scheme Online Application Form.

- NPS Vatsalya Scheme Registration.

- Protean e-Gov Technologies Limited Website.

- PFRDA Website.

- NPS Vatsalya Scheme Guidelines.

- NPS Vatsalya Scheme FAQs.

Contact Information

- NPS Subscriber Helpline Number :- 18002100080.

- PFRDA Toll Free Number :- 1800110708.

- PFRDA Contact Numbers.

Do you have any question regarding schemes, submit it in scheme forum and get answers:

Feel free to click on the link and join the discussion!

This forum is a great place to:

- Ask questions: If you have any questions or need clarification on any aspect of the topic.

- Share your insights: Contribute your own knowledge and experiences.

- Connect with others: Engage with the community and learn from others.

I encourage you to actively participate in the forum and make the most of this valuable resource.

| Person Type | Scheme Type | Govt |

|---|---|---|

Stay Updated

×

Add new comment